Only three residents spoke during a public hearing on the 2023 Unified Government budget Thursday night.

Carolyn Wyatt said she was in support of Mayor Tyrone Garner and a proposed budget that would split the BPU PILOT fee into separate classes, and she supported lowering the mill levy.

Wyatt also supported community centers having their own funding for operating. She said the restrooms at the Beatrice Lee Community Center needed to be ADA certified and needed wheelchair access. Also, the crosswalk leading to the Beatrice Lee Community Center has cracks in it and needs looking at, she said.

In addition, Wyatt said the Boston Daniels Park needs to be upgraded, and tennis courts at Klamm Park need to be upgraded.

Cece Manck also spoke and agreed that the parks need work. She said the budget needs to be redone, and she did not support adding another tax to people. “Can you please give some of the money back to the people?” she asked.

Melvin Williams also spoke and was in support of the need to update parks, but not at the expense of an extra tax to the people.

Williams said he would like to see the mill levy lowered between 1 and 3 percent for a start. He said residents are tired of being burdened with tax hikes.

He said the UG should stop giving new businesses a lot of tax breaks and incentives.

“I know we can find a way in this budget to do some stuff around our community,” he said.

During the meeting, the commission heard a financial presentation from Kathleen von Achen, UG chief financial officer. A total of $420 million has been budgeted for expenditures for 2022.

The commission also heard a presentation about the Community Development Block Grant funds.

Commissioner Christian Ramirez said his stance still hasn’t changed from last week, when Mayor Garner and UG staff presented a plan to lower the mill levy for the property tax, institute a half-cent sales tax for Kansas City, Kansas, and separate the BPU PILOT fee into residential and other classes, with the possibility of lowering the residential PILOT fee.

Ramirez said he felt that there were strong reasons against the sales tax, including that it is considered to be regressive and could hurt lower-income residents more in the east end of the community, and possibly add more debt to what the UG already has.

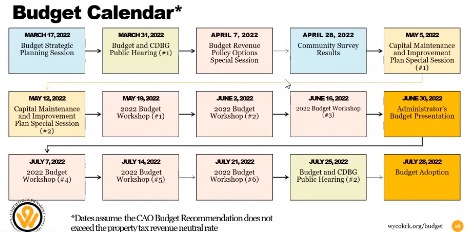

He said there is a need to talk more with the community, and take their time. A budget calendar presented on Thursday night had a very short time crunch, he said. The ordinance to have a sales tax on the August ballot would have to be approved by the end of May, which doesn’t give much time to go to the community, get their opinions and do education, he said.

While everyone wants tax relief, it needs to be strategic and not a drastic change to what they’ve been doing, Commissioner Ramirez said.

He also asked again for a meeting with the other taxing jurisdictions and governmental bodies in the county.

He said the UG, commission and mayor need to compromise and find a budget that is perfect for the community.

Mayor Garner said previously that he had already started a process to hold meetings with other taxing jurisdictions.

Von Achen was asked about the “revenue neutral” definition by Commissioner Gayle Townsend. The term refers to a law passed by the state Legislature last year. A city or county that chooses to exceed the amount of property tax revenue that it collected in the previous year would have to hold a public hearing for the community. A city or county could keep the same mill levy rate as last year and still exceed the amount that is collected if the valuations of property have increased in the past year, as they have in Wyandotte County. Then, to keep it “revenue neutral,” the governing body would have to reduce the mill levy. Schools and other public governing bodies also fall under this law.

Even if the UG lowered its mill levy rate, the homeowner’s overall property tax bill could still increase if other jurisdictions increased their taxes.

Commissioner Harold Johnson said he supported Wyatt’s requests to put more money into areas such as parks and recreation, particularly east of I-635.

He said he would volunteer to be part of the dialogue with other taxing jurisdictions. Before he would consider lowering the mill levy, Johnson said he would need to know and be part of the conversation to know what the priorities are.

The UG uses only 47 percent of one mill, with the school districts, community college, libraries and state making up the rest of the mill, Johnson said. The figures change slightly in different school districts. Commissioner Johnson said he would not consider lowering the mill levy until they have that conversation with the other taxing jurisdictions.

Commissioner Tom Burroughs said he believes that going through the UG’s budget, there are ways to reduce the budget to provide a revenue neutral rate or mill levy reductions.

If the UG doesn’t provide property tax relief, they will see an exodus of people leaving the community, he said.

Mayor Garner said that as they move through the budget process, everyone’s voice will be heard. He said taxes are the top issue of the people he has spoken to.

With all the needs of the community, there are a lot of hard decisions that will have to be made by the commission, he said.

He asked the commission to be mindful of some of the residents in the community who are struggling with their utilities, and are on fixed incomes.

Commissioners Ramirez and Chuck Stites agreed that conversations with other taxing jurisdictions should be open public meetings with all members of the governing bodies.

Von Achen briefly explained the BPU PILOT fee idea.

Two classes could be created, one residential and one commercial, for the PILOT fee, she said. During the budget process, UG commissioners could determine what percentage of revenue the PILOT would be, she said. There could be different percentages for commercial vs. residential, she said.

Currently there is one PILOT percentage for all BPU customers. The charter ordinance would have to be amended for this change, which would require eight votes, she said. After approval, there would be a 61-day waiting period to field any protest petitions from residents, she added.

Also, the UG also could address the PILOT fee issues by expanding a program for low-income households, she said.

The current senior citizens and disabled utility rebate program could be expanded, she said. It is now limited to those 65 and older who have a household income of $25,000 or less.

The program could be adjusted to be open to all ages and limited to a low income level, she said.

Von Achen said if the program expanded to help 1,500 households, it might cost an additional $200,000 to provide relief.

These are ideas they are currently looking into, to be discussed more in later budget meetings, according to von Achen.

More details on the meeting can be found at https://www.youtube.com/watch?v=Dxx3mtzwsWI.