by Mary Rupert

County Administrator Doug Bach today proposed a $323 million Unified Government budget for 2016 that has the same rate – 82 mills – as last year.

“Our community outlook is positive,” Bach said in his budget presentation. Population has grown nearly 4,000 since the 2010 census; new single-family building permits are stable; new county development projects totaled more than $630 million so far in 2015; and Wyandotte County ranks 28th nationally out of 339 of the largest counties in job growth nationally, he said.

Property valuation is up 4.5 percent, Bach told the UG Commission at the annual budget presentation. Some of the valuation growth may be due to the new development projects. The increase in valuation will result in $1.1 million more for the city and $1.5 million more for the county, he said.

For the average taxpayer, if the home valuation is the same, then the UG’s portion of the tax bill will be the same as last year, according to UG officials. Those who have had an increase in valuation may see an increase in the UG’s part of the property tax bill. The average homeowner’s tax bill in Kansas City, Kan., is about half UG (which is city and county), and the rest is largely school district, college and state taxes.

Under this proposed budget, the city general fund would be $148,447,455 while the county general fund would be $54,954,205. The proposed 2016 city mill levy would be 43.473 mills, while the proposed county mill levy would be 38.488 mills.

Bach explained that while the budget total has increased from $295 million last year to $323 million this year, it was largely the result of two accounting changes, not operations changes. One was that the STAR bonds had to be reflected in the budget, at $6 million, he said, when they had not been shown in the budget previously. The reality is that the STAR bonds are ahead of schedule and should be paid off by the end of next year, he added.

Also, a special asset fund is in this year’s budget, he said, that reflects the potential sale of the Hilton Garden Inn in downtown Kansas City, Kan., and the Legends Theater, both UG properties. At this point it is an accounting measure without any real effect on the bottom line, adding $18 million for potential revenue and expense, according to Bach.

Other revenues

Sales tax collections are up about 1.7 percent, about $600,000, he said.

There are some one-time revenues in this year’s budget, including a land payment of $9.5 million. Cerner and Sporting Kansas City are paying $9.5 million for land near 98th from State Avenue to Parallel Parkway. In addition, the UG is receiving a penalty payment of $1.4 million in 2015 from Hollywood Casino because it did not build a hotel.

Bach also said the forecast for revenue of PILOT (payment in lieu of taxes) fee on residents’ Board of Public Utilities bills would be decreased 4 percent, for a $1.3 million reduction in revenues. The UG also will lose about $400,000, because of legislative action doing away with the mortgage registration fee.

Spending goals

According to Bach, some of his goals in this year’s budget were to build up the fund balance, repay special funds that had been borrowed from earlier, fund parks and recreation programs including a summer mowing program, fund public safety task force recommendations, employee raises of 1.5 percent this year, capital investment, urban redevelopment plan, addresses animal control, and a new open data – innovation program.

The UG tonight introduced a new online open data tool that residents may use for finding out about the budget.

Bach said proposed improvements to the parks include the design for an accessible playground; online scheduling and payments for parks facility rentals; adding a horticulturalist and a maintenance employee; more marketing of programs, and futsal court improvements.

For public safety, the proposed budget includes a human resources recruitment specialist; a recruitment budget; certification of promotional testing; restoring the police cadet program; establishing a fire trainee program; and reducing the fire recruit age from 21 to 19, he said.

Employees will get a 1.5 percent increase in 2015 and the same in 2016, under this budget, with 2 percent planned in 2017.

Bach said economic development in the Village West area has generated almost $20 million in property taxes a year, with the UG getting about half of it.

“That is money from those economic development projects that really helped sustain us over the downturn in our economy and lost revenue we didn’t receive once the machinery and equipment (tax) went away through state legislative changes,” Bach said. “Having that in place has had a big impact across our whole community This year we focus more on a one-time land payment that has come in, at about $9.5 million from our deal with Cerner and Sporting Kansas City, which is allowing us to repay some of the funds we had to borrow from in previous years, and also target money toward new capital in our community.”

From the $9.5 million, he is proposing $3 million for operating expenses; $2 million to restore the fund balance; $2 million to restore the health fund where money was borrowed previously; $500,000 each to the worker’s compensation fund, water pollution control fund; and environmental trust fund; and $1 million for capital equipment.

The UG’s proposed capital investments for 2015-2016 include $18 million for street construction and maintenance; $24 million on storm and wastewater projects; fire station planning study, $400,000; $1 million for 30 police patrol vehicles; police body cameras, $750,000, if a federal grant is approved; four fire support vehicles, $185,000; two fire trucks, $1.2 million; three fire ambulances, $630,000; six sheriff patrol vehicles, $165,000; public works vehicles and equipment, $150,000; parks and recreation vehicles and equipment, $290,000.

Bach said once the needs are identified in the Fire Department study, the UG will be ready to move forward in the future on the highest priorities of the study.

Animal control is slated to have a new civilian manager, Bach said, a new animal control officer, and a facility renovation.

Also proposed is an urban development gap fund, he said. The fund will match other dollars for projects including land acquisition, demolition and infrastructure. Also proposed is a small business start-up assistance fund. The budget includes $110,000 for boarding up and demolition. An urban development specialist would be part of this budget area.

Open data and innovation is another proposed area, which includes a restructuring of technology services, a chief knowledge officer, the online data tool and platform, website content management system upgrade and a new initiative contingency fund. This contingency fund would be driven by the UG Commission, according to Joe Connor, assistant UG administrator.

The website content management system will include upgrades allowing people to pay their tickets online, make parks reservations online, and it will include the appointment system for the motor vehicle department to reduce the time spent in line, according to Connor.

The new open data platform has 10 years’ worth of UG financial data on it now, including the 2015 and 2016 proposed budget, Connor said.

“It does make our financial information much more accessible and much more transparent,” Connor said. It is also more efficient for the staff, according to Connor. He added the budget staff has already seen the benefit of it as it works on the budget.

For example, Connor said this data system may be used by UG commissioners, administrators and the public to track overtime expenses in various departments for certain times of the year. Or it might be used to track how much fuel the UG buys, comparing different years, departments or months.

Budget breakdown

Budget Director Reginald Lindsey said property taxes are the largest source of UG revenue, with 26 percent; followed by charges for services, 16 percent; sales tax, 15 percent; and franchise fees, 12 percent.

Public safety is the largest expenditure of the budget, at 39 percent; public works, 21 percent; bond and interest, 15 percent; and community services, 12 percent; according to Lindsey. The 2016 budget funds $7 million more in capital expenditures than did the 2015 budget, he said.

A tax calculator, for homeowners who want to see what the taxes are on their homes, is located at http://landsweb.wycokck.org/ProposedTax/Default.aspx.

According to the budget document, the Kansas City, Kan., city taxes on a home with a $100,000 market value would be $499.94 in the 2015 amended budget and the same in the 2016 budget, if valuation remains the same on the property. The Wyandotte County taxes for the 2015 amended budget would be $442.61, with the same amount for 2016, if valuation remains the same on the home. The total property tax bill on this $100,000 market value home would be about $1,881.92, but only if the tax rate from the school district and community college remains the same as 2014. The UG’s portion of the tax bill would be $943.

Budget meetings

The UG administrator’s budget recommendations will be discussed in the future weeks in budget meetings. The UG Commission is scheduled to vote on the budget July 30.

A public hearing on the budget is scheduled at 5 p.m. Monday, July 27, in Commission Chambers at City Hall.

Several financial discussions have already taken place this year with the UG Commission, which gave some direction on priorities to the administrator. Future budget workshops, most in the fifth floor conference room at City Hall, include:

• 5 p.m. Thursday, July 16, budget workshop, fifth floor. A maximum mill levy is expected to be set.

• Monday, July 20, immediately after the Public Works and Administrative Human Services Standing Committee meetings, budget workshop, fifth floor.

• 5 p.m. Thursday, July 23, budget workshop, fifth floor.

• 5 p.m. Monday, July 27, final budget public hearing for UG and CDBG budgets in the Commission Chambers, City Hall.

• Monday, July 27, after the public hearing, budget workshop if needed, Commission Chambers, City Hall.

• 7 p.m. Thursday, July 30, budget adoption, Commission Chambers, City Hall.

Information about a few UG department budgets

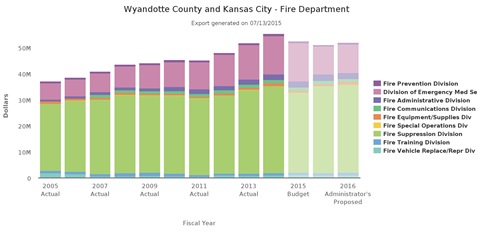

According to the UG’s new open data site, the Kansas City, Kan., Fire Department shows a proposed budget of about $52.1 million, as compared to the 2015 amended administrator’s budget of $51.2 million, the original 2015 budget of $52.6 million, and down from $55.3 million in 2014.

The Kansas City, Kan., Police Department shows $49.2 million proposed for 2016, an increase over the 2015 amended administrator’s budget of $48.2 million, less than the original 2015 budget of $51.1 million, and close to the 2014 budget of $49.4 million.

The Wyandotte County Sheriff’s Department showed a 2016 proposed budget of $23.8 million, as compared to a 2015 administrator’s amended budget of $23.6 million, and an original 2015 budget of $23.05 million, which was down from $24.4 million in 2014.

The UG Public Works Department, not including the T-Bones stadium expenditures, showed a 2016 proposed budget of $67.5 million, compared to the 2015 administrator’s amended budget of $65.4 million, the 2015 original budget of $58.7 million, and the 2014 budget of $54.7 million.

Budgeted for the T-Bones stadium (listed under Public Works) in 2016 would be $300,000, as compared to $650,000 in the administrator’s amended 2015 budget and $275,000 in the original 2015 budget.

Parks and Recreation showed a 2016 proposed budget of $7.7 million; 2015 administrator’s amended, $7.3 million; 2015 original budget, $7.0 million; and 2014 budget, $6.3 million.

Information is from the open data website at www.wycokck.opengov.com.

Contact Mary Rupert, editor, at [email protected].