A Unified Government committee on Monday night advanced bond issues for the Homefield development project totaling up to $270 million.

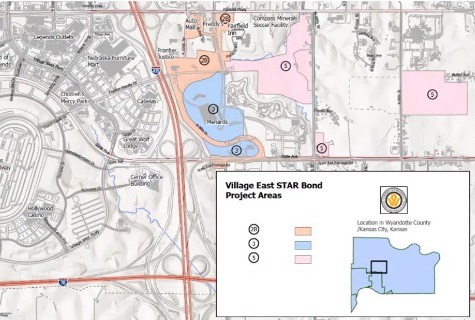

The approval for the bonds now will go to the UG full Commission meeting on Thursday, April 7. The Homefield development is located near 90th and State Avenue, in an area including the former Schlitterbahn water park plus some surrounding land.

The three items that were approved Monday night by the Economic Development and Finance Committee include up to $160 million in STAR (sales tax revenue) bonds; industrial revenue bonds up to $65 million for the Homefield sports building, a multi-use recreational and commercial facility; and industrial revenue bonds of up to $45 million to acquire, construct and equip the Homefield baseball complex.

The $648 million project also includes a Margaritaville hotel and resort, with 250 rooms. STAR bonds will fund about $130 million of the project, with the rest from private investments by developers and their associates, according to Kathleen von Achen, UG chief financial officer.

When the project is completed, it is estimated to produce about $10 million a year in new property tax revenue, von Achen said.

The development agreement for the Homefield project was approved previously in January, according to von Achen.

The STAR bonds will refinance an $8.5 million Series 2015B STAR bond issue, from the Schlitterbahn era, that will eliminate the UG’s agreement to use revenues to cover shortfalls in sales tax revenues to repay the 2015 bonds, according to von Achen.

The Homefield building and Homefield baseball are scheduled to open by July 1, 2024, according to Katherine Carttar, UG economic development director.

The IRBs will have a 10-year payment in lieu of taxes schedule for each part of Homefield.

An outside consulting firm, PGAV, estimated that the development would have a positive effect on businesses that are in or near the Village East redevelopment area.

For example, when the development is built, Freddy’s restaurant was estimated to increase its annual sales volume by $600,000; the nearby Menard’s store was estimated to have a $235 per square foot sales volume; Frontier Justice was estimated to have an $8 million in annual sales; Camping World was estimated to have $40 million in annual sales volume; and a Jeep sport utility vehicle dealership was estimated to have annual sales of $36 million, according to PGAV figures.

For more details on this project, view the meeting video at https://www.youtube.com/watch?v=H3mrskVcxDc.