Cuts, furloughs proposed

No mill levy increase proposed, no PILOT fee increase proposed

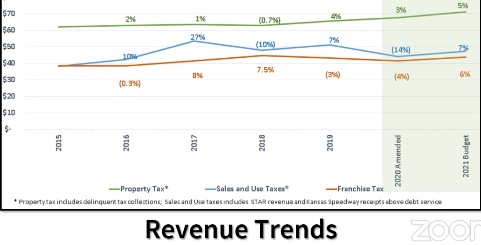

Unified Government Administrator Doug Bach on Thursday night proposed a $380.3 million budget for 2021 that included cuts to operating expenses, reflecting a dramatic decrease in sales tax revenue for this year and next.

The UG will dip heavily into its fund balances, using those funds to offset some of the sales tax losses, according to Bach.

Furloughs have already started at the UG, with non-public safety employees required to take off 10 unpaid days.

While the mill levy stays flat under the proposed 2021 budget, residents could see a slight increase, as valuations in the county are up about 5 percent, according to officials.

“COVID-19 has had a big impact on where we’re at,” Bach said. It has had an effect on the health of residents and has restricted business operations, resulting in lost revenues and high unemployment, Bach said at the 5 p.m. UG Commission meeting June 25.

The UG experienced a loss of more than $23 million in revenues in 2020 and has estimated a loss of $18 million in revenues in 2021, he said, largely caused by the sharp drop in sales and gasoline tax collections. The drop was caused by the economy being shut down for several months in an effort to prevent the spread of COVID-19.

There is no mill levy increase for the property tax, and no PILOT (payment in lieu of taxes) fee increase proposed in Bach’s budget. There are some increases to other fees, including the trash fee and sanitary sewer fee.

The administrator’s proposed budget will be discussed by the UG Commission, which could change it and then pass a final budget on July 16. The next budget workshop will be July 9. The final budget public hearing will be July 13.

Bach said the UG Commission has already had a lot of opportunity for discussion of the budget, with three workshops and a public hearing already held, and more workshops are scheduled before the final vote.

“The drivers for this year’s budget, again, was COVID and the impact on revenues,” Bach said.

Expenditures outpaced revenues, and they knew they had to reduce expenditures, he said. The sales tax loss had more of an effect on the city general fund, which relied more on sales tax, he said.

The UG is using its emergency fund balance to get through this year, and maintaining the lowest practical tax burden for residents to accomplish objectives, he added.

The 2021 budget presented Thursday is $11 million lower than the original 2020 budget, Bach said. Since then, the 2020 budget has been reduced.

Besides furloughs and using fund balances, the UG has been trying to use less cash, and has taken one-time internal fund transfers. Those transfers will have to be paid back in future years, he added.

The UG has put service delivery efficiencies in place to provide the same or higher level of service at lower cost, he said; however, they also are seeing some service reductions because they are holding almost 300 vacancies now among the staff, he said.

“We are doing our services that we laid out without any kind of mill levy increase, and taken on a dramatic decrease in sales taxes revenues for this year and next,” Bach said.

The proposed budget for 2021 is $288.7 million for the city of Kansas City, Kansas, and $91.5 million for Wyandotte County, according to the budget document. The proposed property tax rate of the city is 38.398, the same as 2020. The proposed county mill levy rate is 39.263, the same as 2020.

Bach used a community survey to look at residents’ top priorities. He also has asked commissioners about their priorities.

Although the 2021 mill levy is expected to be the same as the 2020 mill levy, the amount of revenue they produce is expected to increase by 5 percent, as valuations have gone up overall, according to Kathleen von Achen, UG chief financial officer. Wyandotte County assessed valuation was $1.29 billion in 2019; $1.36 billion in 2020; and estimated at $1.44 billion in 2021.

She said their estimates also have taken into account that property tax collections could be down due to COVID-19.

The consolidated city-county general fund is $228.18 million, according to Debbie Jonscher, deputy CFO. Sales tax only accounts for 10 percent of the revenues on the county side, she said.

Some projects still moving forward

While the focus this year has been on reducing expenses to get through the losses caused by COVID-19, there are still highlights and projects moving forward in Kansas City, Kansas, according to Bach.

The Merc grocery store project is scheduled to open in downtown Kansas City, Kansas, in July, the Boulevard Lofts project is underway, the Lanier project is scheduled to renovate the space where the Reardon Center is, the YMCA lofts project is underway and the new county juvenile center will open in a month and a half, he said.

Also, the new Turner Diagonal highway remodeling project will open up that area to new industries, the Leavenworth Road second phase improvements are taking place, and the University of Kansas Medical Center area continues to grow, Bach said.

More budget details

Reginald Lindsey, budget director, said the UG funded less in cash and more in debt for the 2021 budget. Also, he said there were no employee merit increases, there was a 7 percent increase in health insurance costs and an increase in inmate housing and medical costs.

Public safety takes up most of the city’s general fund budget, at 59 percent, followed by community services at 12 percent and public works at 11 percent.

For the county, public safety takes up 55 percent of the budget, followed by general government at 20 percent and judicial services at 11 percent.

Lindsey said the proposed 2021 budget does include some increases in fees.

The residential trash and recycling fee is proposed to increase 35 cents a month; the sanitary sewer fee will increase 5 percent in 2021; and other user fee increases would total 10 percent. Those fees, to increase in the fall of 2020, include building, right-of-way, planning, fire inspection, garage sale permits and others.

Gordon Criswell, assistant UG administrator, said the 2021 budget would fund some efforts to reduce blight, including abatement team equipment and some improved efficiencies for demolition. Not funded will be all seasonal positions including mowers and laborers for the parks. Also, a second abatement team will not be funded, he said.

For public safety, the police body camera initiative will include new civilian positions and the UG is starting to purchase the body camera equipment, he said.

The Sheriff’s Department will add five court security officers in preparation for the opening of the new juvenile center.

The Pierson Park consolidated fire station is in the 2021 budget, and there is an increase in the budget for the inmate medical contract, he said.

The 2021 budget also contained funds for a county building security x-ray machine, and there are juvenile services facility maintenance positions.

Also in the 2021 budget are the archiving and digitizing program for the district attorney’s office, as well as police patrol vehicles, fire trucks and ambulances, he said.

Not funded are 24 police officer positions, and there is a reduction in city building security, reduced public safety building maintenance funds and district court courtroom improvements, he said.

He said community health expenses in the budget included COVID-19 expenses including funds for contact tracing, personal protective equipment supplies, personnel and testing.

The UG also has budgeted for Clifton and City Park improvements through Community Development as part of the NRSA program, he said.

Criswell said a trail network will be funded out of the tourism fund and the Health Department will get a negative pressure room.

Not funded this year will be pool and spray parks, and there will be reduced funding for other recreational programs, he said.

Alan Howze, assistant UG administrator, said the small business grant loan program has been funded with $50,000 in direct grants to small businesses. Also included is $175,000 in Alt-Cap business loans that leverage $1 million for Wyandotte County businesses, he said.

Transit grant funding is being received through ATA from the CARES Act to maintain full bus operations, according to Howze.

Not funded will be economic development professional services and master planning studies, he said.

The budget includes funds for enterprise resource planning, as well as Accela software for planning and the Neighborhood Resource Center, he said. Also in the budget is a human resources diversity and inclusion study, he added.

There also is funding for COVID-19 communications, for a new director of development coordination and customer service success, and electronic plan review software.

Not funded is the strategic communications analysis implementation plan that was previously approved by the commission, he said.

The budget also includes three new positions for the Wolcott water treatment plant expansion, Howze said. Also included is sewer infrastructure maintenance, the street preservation program, the Hutton Road and Leavenworth Road intersection project, pretreatment equipment including sweepers, snow plows and spreaders, fleet vehicles and funding to improve buildings in the parks, and adding air conditioning to the community centers.

Not funded are 19 positions in the street department, he said. In addition, there is a reduction in annual street maintenance, a reduction in vehicle purchases, deferred $1.2 million in facilities funding, decreased right-of-way mowing and reduced City Hall facility improvements, he said.

Bach said there are varying levels of funding that are going to outside agencies. The agencies were scheduled to have the same level of funding this year.

For every dollar spent in taxes, about 46 percent goes to the Unified Government, while 54 percent goes to other taxing entities such as school districts, community colleges, libraries and the state of Kansas, he said.

Mill levy rate changed slightly

The mill levy rate changed slightly from 2019 to 2020, according to Commissioner Melissa Bynum.

Commissioner Bynum said that the commission didn’t vote for an increase in the mill levy that year.

The slight increase – about two-tenths of a mill – came about when some tax appeals cases were decided in court, according to von Achen. The decisions resulted in a lower valuation figure for the county.

Von Achen said that when the commissioners adopt the budget, they are adopting the dollar amount that they seek to generate through taxes. They used the June certified values from the clerk to determine that valuation, and the mill rate was set.

Then, between June and October, the valuations changed and the mill levy rate then was changed, while the dollar amount of the budget remained the same, according to von Achen.

CARES Act to provide additional revenues

The federal CARES Act could bring as much as about $37 million to the county, however, the money is restricted by federal law. It cannot be used to replace lost revenue in the UG’s budget or take the place of budgeted expenditures, Bach said. Also, it can’t be used for capital construction costs.

The federal money could pay for additional expenses the UG has taken on because of COVID, he said. Different cities in the county, schools, nonprofit organizations and for-profit businesses can apply for the federal assistance, he said. The UG will place an application for the funds on its website on June 29, then review applications starting July 13, and submit a plan to the state for approval by August, he said. The money has to be spent by the end of the year.

For more budget details, the June 25 budget presentation is online at https://www.youtube.com/watch?v=3L8sMIueoQQ

The 815-page UG budget document is online at https://www.wycokck.org/WycoKCK/media/Finance/Documents/Budget/2020-Amended-2021-Proposed-Budget-Unified-Government-WYCO-KCK-FINAL.pdf