Wyandotte County real estate appraisal notices went out Friday, and are showing an average 8 percent increase for 2020.

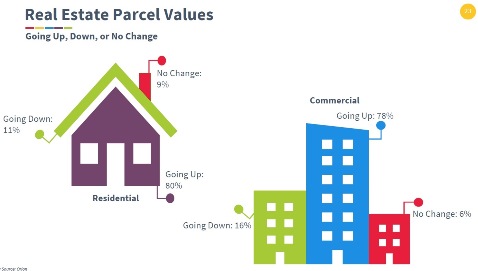

About 80 percent of the properties in Wyandotte County will see an increase in valuation, according to a Unified Government news release.

The amount of increase for each property will vary, depending on market trends, area demand and changes made to a property, according to the UG spokesman.

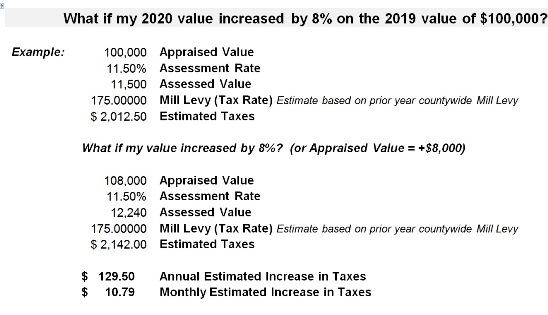

A home with an appraised value of $100,000 in 2019, with an assessed value of $11,500, would have paid estimated property taxes of $2,012.50 in 2019, according to figures from the appraiser’s office.

The same home, with an 8 percent increase, and an appraised value of $108,000 in 2020, with an assessed value of $12,240, would pay estimated property taxes of $2,142, if the mill levy rate remained the same as the previous year.

The annual estimated increase in taxes for a $100,000 home that went up 8 percent in valuation would be $129.50, with the monthly estimated increase in taxes at $10.79, according to figures from the appraiser’s office. That amount could change if a different mill levy rate was implemented.

The UG has started its budget process, and has already held one public hearing on the UG budget. The second budget public hearing is scheduled at 5 p.m. July 13 at City Hall, with the budget scheduled for approval at 7 p.m. July 16. The UG’s maximum mill levy is scheduled to be set May 21. The school districts and other taxing districts in the community also will be holding budget sessions and hearings.

The appraiser’s office has issued the 2020 Valuation Report, available online at www.wycokck.org/appraiser.

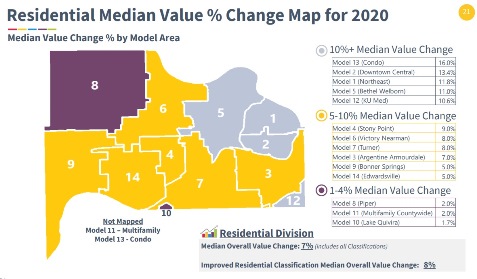

One of the maps in the valuation report showed that property values were raised the most in the downtown, northeast, Bethel-Welborn and University of Kansas Med areas, ranging from an average 10.6 percent increase in the KU Med area to an average 13.4 percent increase in the Downtown-Central area.

The map also showed an average 5 to 10 percent median value increase in most of the county’s territory. In this range were Stony Point, 9 percent; Victory-Nearman, 8 percent; Turner, 8 percent; Argentine-Armourdale, 7 percent; Bonner Springs, 5 percent; and Edwardsville, 5 percent, all averages.

Piper and Lake Quivira were in the average 1 to 4 percent median value increase areas, with Piper at an average 2 percent and Lake Quivira at an average 1.7 percent. Also, valuation of multifamily housing countywide went up an average 2 percent, according to the map.

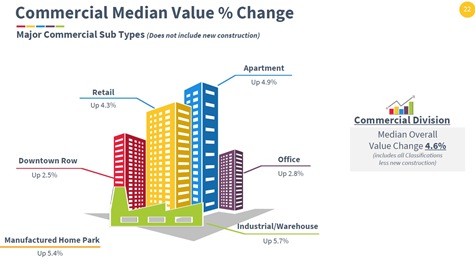

Commercial real estate experienced a median overall valuation increase of 4.6 percent, according to the 2020 Valuation Report.

Retail saw an increase of 4.3 percent; downtown row, up 2.5 percent; manufactured home park, up 5.4 percent; apartment, up 4.9 percent; office, up 2.8 percent; and industrial warehouse, up 5.7 percent.

According to the UG news release, if property owners think their property would not sell for the appraised amount, or if they think the property was not classified correctly, they can appeal.

The deadline to appeal the valuations is Monday, March 30, according to the UG.

An appeal form is online and may be submitted at www.wycokck.org/appraiser, according to the UG news release. It also may be emailed to wycoappraiser@wycokck.org, or may be mailed, faxed or delivered in person to the appraiser’s office at 8200 State Ave., Kansas City, Kansas.

The appraiser’s office will set up an informal appeal meeting either in person, on the phone or by the information submitted, according to the UG. Property owners should bring or submit documents to support the appeal, such as a recent fee appraisal, photos of the conditions that can’t be seen from the exterior, or comparable properties that have sold that the property owner feels represents the value of the property.

After the informal appeal deadline has expired and a property owner did not initiate a timely appeal, the next opportunity to appeal will be when the 2020 tax bills are due, which is on or before Dec. 20, 2020, according to the UG.

Property value information and appeal information is available on the Wyandotte County Appraiser’s Office website at www.wycokck.org/appraiser. Property owners also may contact the Appraiser’s Office directly with any questions by calling 913-573-8400.

I think it’s time to stop raising property taxes. Stop giving away Tiff and STAR bonds to attract business so they can leave or close a few years later. The residents of WYCO deserve better.

Why are we raising property valuations? My property hasn’t been improved. I can barely afford what I paid last year. Do they want people to stop paying so they can take the property? I thought they were going to lower taxes???