Sales tax from STAR bond payoff pumps millions into treasury

by Mary Rupert

Largely because of an influx of $12.4 million from sales taxes at the Village West area, the Unified Government will be able to reduce city taxes by 2 mills and still add some major improvements.

Among the improvements outlined in the proposed budget are a new Juvenile Justice Center, nine new fire trucks and vehicles and 30 new police vehicles, police body cameras, a new fire station and blight reduction. There are also road repairs, and major improvements to Leavenworth Road and Hutton Road in the budget for 2018, along with Wyandotte County Lake roads.

Unified Government Administrator Doug Bach also proposed a 2 percent increase in pay for UG employees.

A resident with a $100,000 home would pay $905 to the city and county portion of the property tax under this budget proposal, according to UG officials. The previous year, the tax on a $100,000 home was $925, according to Bach, and in 1995, it was $1,116. Some commissioners point out, however, that if a home’s assessed valuation increased, that could offset the tax rate reduction.

Bach presented his 2018 budget plan, which reduces property taxes by 2 mills, at 5 p.m. July 6 at a Unified Government Commission meeting. The 2017 budget also reduced property taxes 2 mills. The UG has been working on the budget for 10 months, according to Mayor Mark Holland.

The UG is feeling the effects of the sales tax revenue (STAR) bonds being paid off early at Village West, with $12.4 million in sales tax revenues coming into the UG treasury. Of that total, $9.4 million wlll go to the UG city and county general funds, while the rest would go to to the dedicated sales tax fund and the emergency medical services fund.

The influx of the Village West STAR bond funds, with the reduction of the city property tax by 4 mills over two years, represents a slight shift in the UG’s tax base toward more reliance on sales tax revenues, according to UG officials.

As the UG is starting to rely more now on sales tax revenue, which can fluctuate, it also is trying to build up its fund reserves to 10 percent, according to the budget document. The UG had 10 percent in reserve for 2017, and is expected to have 9.1 percent in its fund balance in the 2018 budget. The UG may try to reach a 16 percent fund reserve in future years, according to the budget document.

The UG takes the view that the local economy will continue to grow and revenues will increase at a modest pace of 1.6 percent during 2018, the budget document stated.

The UG operating budget will increase from $344,228,845 to $357,936,100, according to the budget document, an increase of $13.7 million.

The Kansas City, Kansas, mill rate would be reduced 2 mills under this plan, while the county mill rate would hold constant, according to Bach.

According to the budget document, the Kansas City, Kansas, general fund will increase from the current year estimate of $150, 042,878 to the proposed $168,981,526, under the proposed budget, with a city tax rate of 39.875 mills, a reduction from 41.8 mills in 2017.

Under this proposed budget, the Wyandotte County general fund will increase from the current 2017 estimate of $59,534,826 to the proposed 2018 general fund budget of $67,748,858, with a county tax rate of 38.813 mills, the same as the 2017 county rate.

The 2018 budget also contains a 6 percent rate increase on water pollution control fees in order to make improvements that are required by the Environmental Protection Agency, according to UG officials.

$2.2 million in budget reductions

Bach said some operational costs increased last year, and the UG had to go back and reduce the budget by $2.2 million out of the general fund areas of the budget. He said they tried not to focus on areas that had the highest priorities as determined by the governing body. He said the UG felt it could do these at a reduced cost.

Bach said the UG reduced costs by about $700,000 from inmate farm-out expenses. Prisoners double-bunk in existing cells instead of the UG paying other jails to house them. The funds saved are being put toward building a new juvenile facility, he said.

For employee compensation, a 2 percent increase has been built into the 2018 budget, representing about $3.2 million, he said. The UG will be negotiating with employee groups.

Also, from the employee base, the UG will be increasing the UG share of the health fund 14 percent, or $3.8 million, he said.

The UG will add $1.2 million in the workers’ compensation fund, he said. While the overall numbers of workers’ compensation cases are decreasing, he said unfortunately, last year some tragic cases came in and overall costs were driven up.

Bach said there are still some challenges not addressed by the budget. These include repairs of older buildings that are owned by the UG, increasing the fund balance, improving the levee system, implementing the parks plan, complying with the ADA directives, and sustaining the dedicated sales tax.

Bach said there has been a 4 percent increase in the community’s population since 2010; about 200 new home permits were issued in 2017 so far; employment was up 2.2 percent in the past year, bringing the county to 92,000 jobs; the county ranks 67th out of the 344 largest U.S. counties in wages, and second in the state of Kansas; and the tax delinquency rate has been reduced from 7 percent to 5 percent.

20-year comparison

Bach’s remarks focused on a comparison of the UG today with the UG 20 years ago, when consolidation took place. A visionary elected leadership has worked on what it can do to make the community better, he said.

In the last 20 years, the mill levy rate has been reduced 19 percent; 24,000 new jobs were added in the community; the population has increased 7.2 percent after a decline before consolidation; and the county is the No. 1 tourist destination in the state of Kansas, Bach said. The perception of the community has improved; the crime rate has decreased; and the UG is more transparent than it was formerly, he said.

Also, there was about $5 billion in economic development here during the past 20 years, including Village West, the 39th Street corridor, and six new grocery stores, Bach said. Manufacturing and retail has greatly expanded, he added.

A 2016 citizen survey and the mayor’s listening tour helped the UG determine its priorities and goals. Reducing blight, increasing safety, increasing health, increasing prosperity, improving customer service and increasing community cohesion are the main goals that influence the budget, he said.

The budget will reduce the Kansas City, Kansas, city property tax rate by almost 5 percent while maintaining the county rate as almost constant, Bach said. The county is building the Juvenile Justice Center without raising the tax rate, he noted.

“We were No. 1 in Kansas City,” Bach said about the city’s tax rates 20 years ago. Unfortunately, the city had the highest property tax mill rate 20 years ago in a comparison to other large cities in Kansas. “Since that time, we’ve reduced our mill rate significantly, and we’ve moved down so out of the 25 first-class cities in the state of Kansas, we’re 13th overall.”

Twenty years ago, the county was 78th, where No. 1 was the highest tax rate, he added. In 2016, Wyandotte County was 95th among the state’s counties for property taxes, he said.

Some other budget expenditures

Some other proposed budget expenditures mentioned by UG officials at Thursday night’s meeting included:

Streets: $25 million total cost: Pothole patcher, manhole cutter, pavement stripper, public works asset management program, engineering study of Holliday Drive, bridge replacement on Holliday Drive, Parallel from 82nd to 89th, Leavenworth Road, Hutton Road, Wyandotte County Lake roads.

Blight reduction: $1.6 million: Demolition, tax sale, animal control, zoning, codes, and for mowing and property maintenance, an additional $200,000.

Sidewalks and trails: $1.5 million cost: Sidewalk gap program, Safe Routes to Schools program, ADA curb and sidewalk replacement, Fairfax trail engineering, Kaw River Bridge analysis with grant funding, and trail development plan.

Transit: $1.4 million cost: Replacement of five buses from aging and transit funds, a bus route to the new Amazon facility, a transit study of Fisher Park with grant funding, ATA contract increase, and increasing Meals on Wheels.

Water Pollution Control: $32.7 million cost: Proposed sewer rate increase of 6 percent, sewer fee analysis, Wolcott sewer plant at $18 million, replacement of Lombardy Drive sewer system; stormwater master plan and fee study, a levee cooperative study, Strong Avenue Levee Pump Station, and 29th and Ohio storm sewer.

Police: $3.7 million cost: Police body and vehicle cameras, fiber network connectivity, 30 police vehicles, 911 communication consoles, Police Department summer work program.

Fire: $6 million cost: New fire station and plan to fund future stations, renovation and repair of existing fire stations, two fire trucks, seven vehicles, maintaining the fire trainee program.

Sheriff’s Department: $25 million cost: New Juvenile Center, continuing double bunking in adult detention center in order to save money and use it toward the new juvenile center, courthouse security upgrades, and two sheriff vehicles.

Innovation and technology: $1 million cost: 311 app to be launched for mobile access, UG website to be launched, integration of Neighborhood Resource Center, 311 and public works systems, using the cloud for storage and solutions, increased GIS and mapping capabilities, and providing assistance to district attorney’s office with record archiving.

Customer service: $335,000 cost: Citizen survey, PayIt Mobile Services partnership for mobile online payments, parking systems upgrade of hardware and software, a small business liaison outreach employee position.

Facility enhancements: $6.6 million cost: Justice Complex cooling tower, courthouse roof replacement, fleet maintenance facility purchase at 54th and Kansas Avenue, Memorial Hall window and heating-cooling system, building asset and inventory management system, and parks restroom upgrades.

Commissioners’ concerns: Valuation and tax reductions

As assessed valuations increase, some residents’ total tax bills may go up even though the mill levy rate is going down. There was an increase to some residents’ valuations this year.

Seventh District Commissioner Jim Walters of Bonner Springs said the $12 to $14 million revenue increase in the sales tax funds from the STAR bond payoff is quite larger than the cost-of-living increase, and asked why the UG is basing the budget increase on something that is higher than the cost of living. He was interested in “a more meaningful tax reduction.”

Walters asked how many residents are paying less in property tax than they did last year, and asked for the percentage. Bach said the UG will be providing Walters with that information.

“When someone has a 10 percent increase in their home price, a 5 percent reduction in their mill levy doesn’t really offset the tax increase,” Walters said. “That’s what our goal really is, is tax reduction, not a lessening of the tax increase.”

Kathleen VonAchen, UG chief financial officer, said assessed valuation in Wyandotte County increased 2.5 percent as a total rate for residential property, commercial property, utilities and personal property, combined. Residential and commercial together increased 3.8 percent for existing property, however, residential and commercial percentages were not totaled separately in the UG’s budget information, she said.

In Wyandotte County, utilities’ valuation declined 12.6 percent, and personal property declined 6.2 percent, according to VonAchen. If these two categories had remained at 2016 levels, the assessed valuation would have increased by 3.8 percent instead of 2.5 percent, she said.

On the city side of the budget, the valuation figures in Kansas City, Kan., showed utilities’ valuation declined 13.8 percent, and personal property valuation declined 6.3 percent, with a total assessed valuation increase of 2 percent in the city, according to VonAchen.

The combined revenue streams to the general funds, which are the operating funds for the city and county, are showing an increase of about 1.4 percent for 2018, according to VonAchen. In 2017, the combined revenues increased by 8.4 percent because of the additional STAR bond revenues.

She stated that even though residential and commercial properties values have been improving this year, those increases are offset by declines in the personal property and utility property. Together with the proposed 2 mill reduction in the budget, it will result in a net 1 percent reduction in the property tax revenue this year, she said.

The UG saw an increase in sales tax revenue of 28 percent in 2017 because of the $9.4 million from the STAR bonds payoff. For 2018, the UG is projecting that sales tax revenues will increase by 3.8 percent, because of strong growth in the retail and business sector, she said.

She said the UG is projecting a 2 percent increase in franchise taxes this year, linked to the Board of Public Utilities’ electric rate increase, which will provide more revenues to the payment-in-lieu-of taxes (PILOT) charge on the BPU bill, which goes to the UG. The PILOT fee is 11.9 percent.

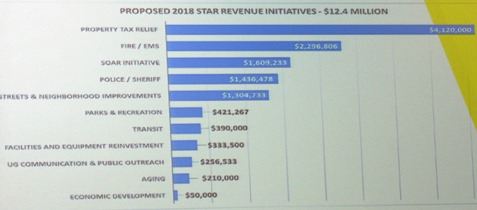

Bach said the largest part of the $12.4 million STAR bond payoff funds is going toward property tax relief, about $4.1 million; some STAR bond payoff funds are designated to go to special funds such as Fire and EMS, $3.3 million, and Police, $1.4 million; blight reduction will receive $1.6 million; and streets and neighborhood improvements will receive $1.1 million.

Walker: DA office funding

Second District at-large Commissioner Hal Walker asked about the district attorney’s budget. Walker, a former UG attorney, is in favor of increasing salaries for outstanding attorneys in the DA’s office, and asked Bach for more information on the salaries.

Walker said he believes attorneys in this office in Wyandotte County may be paid less than attorneys in other DA offices in large cities in Kansas. He said he was interested in providing good-paying salaries so that outstanding attorneys would stay in their jobs longer.

There is currently an increase of about $100,000 to the district attorney’s 2018 budget for capital outlay, which funds equipment, according to UG officials and budget documents.

Johnson: Fund balance

Fourth District Commissioner Harold Johnson, who has a background in banking, said there is always a tension on the commission between spending and how they may increase the fund balance.

He asked for continued discussion on the fund balance, saying it was important for the UG to maintain certain levels for the fund balance. He said he would like to discuss a cohesive plan to reach the stated goals over a period of time.

The UG Commission will hold more budget meetings during July and possibly make changes, and then it is scheduled to approve a final budget July 27.

A public hearing is set at 5 p.m. July 24 at the Commission Chambers, City Hall, 701 N. 7th St, Kansas City, Kansas. Some of the questions brought up by the commissioners will be addressed at future budget meetings. The next budget meeting will be shortly after 5 p.m. Monday, July 10, after the UG Standing Committee meeting. The maximum mill levy will be set July 10.

The UG’s proposed 2018 budget, more than 600 pages, can be found online at www.wycokck.org. The July 6 UG meeting is on YouTube at https://www.youtube.com/watch?v=o5VNXwgbvbM.

“When someone has a 10 percent increase in their home price, a 5 percent reduction in their mill levy doesn’t really offset the tax increase,” Walters said. “That’s what our goal really is, is tax reduction, not a lessening of the tax increase.”

— Seventh District UG Commissioner Jim Walters of Bonner Springs

Thank you Commissioner Jim Walters!

“Bach said the UG will be providing Walters with that information.”

Personally, I abhor my continued harping on this… however, with the many uses of the word “perception” in the opening comments and in the charts covering specific aspects of the budget in this meeting, one can quite honestly begin to seriously wonder what is actual, concrete reality and what is perhaps an attempted projection aimed primarily at the “public’s perception” of this presentation and of the Budget itself. In addition, the nostalgic journey preface, covering the last 20 years of Unified Government rule, does not make tax increase realities more acceptable, nor palatable in the old here-and-now. Perception versus reality.

No mention of the increased costs for the recent T-Bones “subsidy” are noted within this proposed Budget. Should this not be noted in the interest of “transparency” …or is that merely a matter of “perception” as well? Perhaps that money may indeed quietly come from increases in individual BPU rates and fees.

The T-Bones stadium information is on page 133 of the UG budget. You can find the 600-page budget at http://www.wycokck.org.

Thanks Mary. I don’t see the projected 55% additional utility charge coverage to be paid by the UG, (over the reduced rate, charged by the BPU) upon the request of the UG. Perhaps you’ve additional information on that?

It was approved June 29, which is probably why they didn’t bring it up for discussion again on July 6. I do not have information on it. There’s more T-Bones stadium information on page 150, page 433 and page 460 of the budget. Which of their funds they are using is not particularly interesting to me.

https://wyandotteonline.com/ug-makes-deal-with-t-bones/

> A resident with a $100,000 home would pay $905 to the city and county portion of the property tax under this budget proposal, according to UG officials. The previous year, the tax on a $100,000 home was $925, according to Bach, and in 1995, it was $1,116.

$20? While I appreciate the thought, if that money can be better spent improving our city, they should keep that tax rate where it is.

In the future maybe the tax paid could include all levies in the tax statement? I also get great gas mileage if I car when a add estimated mileage for stoplights.

Next year appraised value will drop and mill levy will go up! Same ole games! Notice how much money the taxpayers have benefitted from all the development including the racetrack. Just think how much the taxes will decline in 2018 with tax free Amazon, Soccer Fields, Auto Dealership inventories, to say nothing about the fast foods, medical buildings, and a fantastic community center on Star Bonds lmao! Leaders???

,

For independent reviews and studies of the Unified Government’s “historical” performance and similar Unified Governments throughout our nation… you may choose to refer to the following:

(1). “The Impact of City-County Consolidation On Local Government Finances” — Beverly Cain, Capstone Paper (2009).

(2). “City-County Consolidation – Promises Made, Promises Kept?” — Suzanne M. Leland and Kurt Thurmaier, Georgetown University Press (2010).

Cain’s paper quotes Leland and Thurmaier’s book extensively and is available via simple Google search. Leland & Thurmaier’s book is not so easily found. (No copies at the KCKPL.) Excerpts are however available via a “Google Books” search.

When one’s only source of information on a subject, is limited to reports originating from that subject alone, then your opinion may indeed lack adequate or effective perspective to formulate an informed opinion, other than what your initial singular source provides or intends.

Both publications noted above provide some rather interesting facts and additional background on “our” version of a Unified Government… and others.