Downtown grocery, Turner Logistics Center also on UG agenda Thursday

Lofts would be built at the 8th Street YMCA property, 834 Armstrong, in downtown Kansas City, Kansas, under a proposal to be considered June 13 at the Unified Government Commission meeting.

The item was approved 4-1 at the committee and has advanced to the UG Commission meeting at 7 p.m. Thursday night, June 13, at the Commission Chambers, City Hall, 701 N. 7th St., Kansas City, Kansas.

The project would develop YMCA property into senior housing. The proposed resolution says the UG administrator would be authorized to negotiate the terms of a sale and lease.

The Y Lofts are being developed by Prairie Fire Development of Kansas City, Missouri, the same group that is developing the Boulevard Lofts project at 8th and Washington Boulevard, Katherine Carttar, UG director of economic development, said at the June 3 committee meeting. Prairie Fire also has developed another project in Wyandotte County.

The $8.9 million project would create about 40 units of affordable senior (55 and older) living, according to Carttar. Construction would start in September 2019. Completion is estimated in November of 2020.

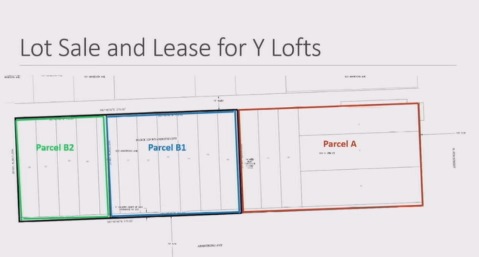

The redevelopment project has several steps, involving selling the property and then leasing surplus property to Y Lofts, Carttar explained.

According to information in the UG agenda, the city of Kansas City, Kansas, sold the property at 834 Armstrong Ave. to the YMCA in 1996, and the deed contained a provision where the property would go back to the city under certain conditions.

The UG, according to a proposed resolution, has reached an agreement with the YMCA and Y Lofts. The YMCA would deed the property back to the UG, the property would be subdivided, and the eastern (center) lot of Parcel B of the property would be sold to Y Lofts while the western (left) lot would be leased to Y Lofts. If they could not develop the eastern part of Parcel B within three years, the UG would get the property back, according to Patrick Waters, UG attorney.

The western part is a parking lot leased to Y Lofts, which may use it as overflow parking. The western lot would be leased to Y Lofts, but a portion of it would remain open to public use, Waters said. The UG would be able to terminate the lease of the western lot at any time if it sees the need to use the parcel for other purposes, he said.

Commissioners discussed the disruption of other businesses in that area by the construction of the nearby center, and asked about provisions being made for the businesses. A representative of the developer said they will use part of the eastern lot for parking during construction and also sidewalks may be closed during construction. The developer’s representative said he would be willing to work with the neighborhood.

Second District Commissioner Brian McKiernan said it was phenomenal that the facility would be inhabited again, and supported the project. He asked if the parking lot would be maintained by the developer, and the UG attorney said it would.

The project will use historic tax credits, according to the developer. Commissioner Ann Murguia, who voted against the resolution, asked about the “huge concentration of low income housing in downtown Kansas City and the fate it will have for downtown Kansas City, Kansas.”

The developer’s representative said he didn’t think the project would have a big impact, as it is geared toward senior citizens. Also, 44 units is not a particularly large development, and the project helps save a historic building, he said. It would have a small impact in Kansas City, Kansas, overall, but would have a nice impact on the downtown Kansas City, Kansas, area, he said.

“I have serious concerns, it’s been going on for years since I’ve been on the commission,” Murguia said at the June 3 meeting. “If you read any academic research articles about the concentration of poverty in particular areas of a city, it’s not particularly good for any area of the city. The strategy that has proven to be most successful has been to develop mixed-income neighborhoods, and they seem to be most sustainable.”

She also said she had an issue with absentee landlords who come to this community and use state tax credits to develop this kind of housing, and when it comes time to locate them for repairs or maintenance, they’re hard to find or pin down to keep the standard of living for people.

“When they come in and want our approval, they’re all about it’s going to be a clean, neat, safe place to live,” she said. “But if you look at any of our properties that have had low-income tax credits in them, it never ends like that. I can cite several.”

She mentioned two projects in Kansas City, Kansas, where there were problems.

“It’s just disheartening to me, because we continue to develop these kinds of projects in our community, and they have not seemed to pan out in our community over time,” Murguia said. “This is a project I’m not excited about. I have not seen anyone do a low-income housing project in Wyandotte County where it’s been successful.”

She said she thinks quality, affordable senior housing is needed, but it comes down to the operations, and she has significant reservations.

UG Commissioner Tom Burroughs said that would be a topic that staff could address in the future.

Commissioner McKiernan mentioned two downtown area projects that had been successful and well-maintained. He said he shared concerns about creating entirely low-income neighborhoods, and the ultimate goal would be to attract mixed-income neighborhoods.

Commissioner Murguia said she looks at who will own and operate developments, are they investing in the community, are they part of the community and do they care beyond turning a development deal in the community.

The owners of one apartment development in Kansas City, Kansas, live in Topeka, and from those apartments there is a drain on the police and fire departments, gang and drug units, and on the community, Murguia said.

The Prairie Fire representative said they are property owners in Wyandotte County and have spent a lot of time with local organizations and commissioners in the projects they’ve worked on. They are quick to answer questions and concerns, he said.

“If Wyandotte County is such a great place to live, why is it that none of your employees lives in Wyandotte County?” Murguia asked.

Carttar said there is a big difference between public housing through Housing and Urban Development and LIHTC (low-income housing tax credits). This project is 70 percent area median income, and 90 percent of seniors in Wyandotte County probably would be eligible to live in this building, she said.

“Prairie Fire has been a really great partner,” Carttar said. Boulevard Lofts is a mixed-income project, she added. That project will provide comparative information on market rates for the downtown area that then can be used to help obtain financing for other housing projects.

Downtown grocery store

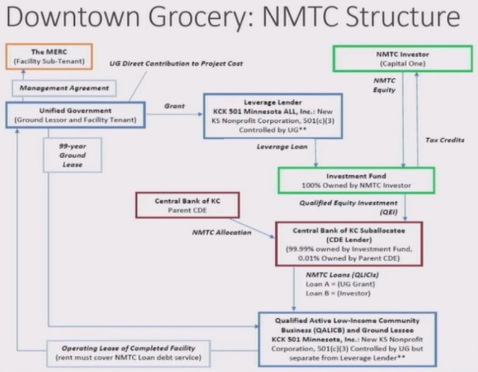

Also on the June 13 UG meeting agenda are an ordinance and resolution to issue $1.42 million in taxable general obligation improvement bonds to provide funds for the downtown grocery store project at 5th and Minnesota Avenue. The bonds would be purchased by the Local Initiatives Support Corp. (LISC). Also, an ordinance would authorize the UG to make a grant into the New Market Tax Credit structure not to exceed $5.5 million.

Carttar said at the June 3 committee meeting that the construction drawings for the new grocery store are being completed this week, construction bids will be taken, then the closing for New Market Tax Credits is scheduled the second week of July, with groundbreaking at the end of July.

“We’re excited that everything is moving according to plan,” she said.

Kathleen von Achen, UG chief financial officer, said on June 3 that there were a variety of financing sources coming in to pay for the $6 million grocery store project. One source was a loan from LISC. Instead of a loan, the UG will issue general obligation bonds that are a private placement. She said they are looking for some assurance from the UG that the loan repayment will be made. The loan is $1.4 million, with an interest rate of 3 percent from LISC, a very low rate, von Achen said. The maturity of the loan is 10 years. It will work out to about $200,000 a year, she said.

The New Market Tax Credits will provide around a million and a half dollars up front, which is a tremendous benefit to the project, according to project officials.

The optional prepayment provisions include prepayment without a penalty. If the tax credits do not close by Sept. 30, the UG will give the money back, von Achen added.

The UG will own the building being constructed, the Mercantile from Lawrence will lease it, and at some point there will be an option to buy it, according to Commissioner Gayle Townsend.

Chris Vukas of Sunflower Development presented a complicated flow chart for the New Market Tax Credit structure. The committee voted unanimously to approve the project, which will be on the June 13 agenda.

Also on the June 13 agenda is a home rule economic development grant to authorize general obligation bonds, approving a ground lease and operating lease, and authorizes a community benefits agreement for the new grocery store. That ordinance also passed the committee June 3.

Turner Logistics Center

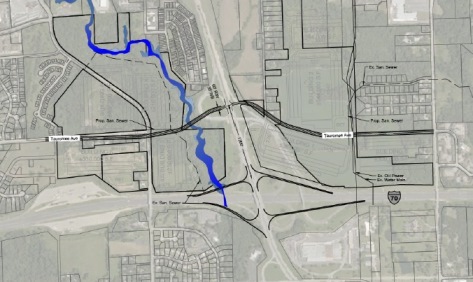

The development agreement for the Turner Logistics Center, near 72nd and I-70, also is on the agenda, with a public hearing scheduled on June 13.

The UG would issue up to $155 million in industrial revenue bonds under the proposed NorthPoint Development project. The Turner Diagonal would be redrawn and a new I-70 diverging diamond interchange would be built there. A proposed resolution of intent states the UG intends to issue bonds for the project.

Carttar said there would be $30 million in the infrastructure and $125 million for the logistics center. It would bring nearly 2,000 jobs to the area, she said.

In the past, the property has been landlocked and has not been able to be developed previously, she said. It was agricultural use previously.

The IRBs would have 100 percent abatement of property taxes for each building for 10 years, according to UG information. While there are property tax abatements, Turner Logistics is required to make a payment each year to the UG and school districts.

Carttar said Turner Logistics would pay the UG and school districts a sum outlined by a schedule that starts at 14 cents per square foot in the first year and increases until it is 48 cents per square foot in the 14th year. The project has a minimum building requirement of 1 million square feet. Turner Logistics would pay $2.7 million to the UG by the 10th year, and nearly $2 million annually when the abatements expire.

Appearing at the public portion of the committee discussion on June 3 was former Mayor Joe Steineger, who said he grew up in the area, and his family owns property there.

“I don’t really want to sell it to some realtor who will make a lot of money on me,” he told the committee. “We’re really not sure what the whole plan is.

“We’d like to more know about what’s going on, what to expect and who we’re dealing with,” Steineger said.

Commissioner Burroughs said staff members would meet with Steineger after the UG committee meeting to discuss the project. Commissioner Murguia said she had notified Administrator Doug Bach of Steineger’s concerns previously.

Another resolution calls for the creation of a Community Improvement District for the Turner Logistics Center project. The UG is putting in $7.5 million, Kansas Department of Transportation is providing $7.5 million, NorthPoint Development will be funding $1.5 million, and the federal government will provide about $14 million, Carttar said.

The UG will be paid all of those funds back from the project, Carttar said. The development agreement payments in lieu of taxes will make sure that the UG is paid back the money, she added. If the developer does not meet the agreement, then the CID will be triggered, she said, with special assessments that would fill in the gaps until the UG receives its money back.

Other items on June 13 agenda

Also on the June 13 agenda:

• A change to boarding procedures and requirements for vacant lots and unfit properties.

• Presentation of the 2018 Comprehensive Annual Financial Report.

• An agreement between the UG and Browndog 9801 LLC on the sale of a car wash facility at 9801 Troup Ave., Kansas City, Kansas.

• An agreement to allow for the building of Blue Cross and Blue Shield Spira Care Medical Center at 9801 Parallel Parkway.

• An ordinance to authorize UG attorneys to initiate legal proceedings including condemnation to acquire property for Piper Creek Regional Improvements, Phase 1.

• An ordinance to authorize UG attorneys to initiate legal proceedings including condemnation to acquire property for the BPU Barber Road to Rosedale 161kV transmission line.

• An ordinance authorizing UG attorneys to initiate legal proceedings including condemnation to acquire property for the BPU Armourdale to Rosedale 161kV transmission line.

• Appointment of Gary Enrique Bradley Lopez to the Advisory Committee on Human Relations and Disability Issues, submitted by Commissioner Gayle Townsend.

• Transfers to the Land Bank: 1269 and 1273 Kansas Ave.; 1527 S.34th.

• Land Bank applications: 1040 Splitlog Ave., 1273 Kansas Ave., 1269 Kansas Ave., 1506 N. 55th Drive and 1527 S. 34th St.

Stormwater rate update and federal legislative program

A special session is planned at 5 p.m. Thursday, June, 13, in the fifth floor conference room at City Hall on a stormwater rate update and the federal legislative program.

The agendas are online at www.wycokck.org.

Taxpayers, Read the above articles to see all the new things your property tax money is paying for. Ridiculous!