by Sen. Steve Fitzgerald

Senate leadership and the governor both have proposed a mix of increased taxes and spending cuts to solve the projected budget shortfall.

Bills to increase taxes are proceeding along with bills to cut spending. The assumption is that there must be both and the only decision is how much of each as well as where to cut and whom to tax. I do not agree. For this year at least there is no case to be made for tax increases of any kind.

More taxes are not needed. With sufficient cuts there is no need for increased taxes. If the economy continues its recovery (it is recovering and it will very likely improve even more quickly) the need for increasing taxes in future years will be reduced. Kansas taxpayers will earn and spend more in a growing economy.

State revenue is higher than last year and recent monthly intake is exceeding both expectations and last year’s revenue. Many states are in deficit territory – Kansas is not – and many states have declining rather than growing revenue.

This is not a Kansas problem – it is an agriculture and energy sector problem. Catastrophic markets in both sectors due to oversupply and a strong dollar have reduced income for a very large sector of Kansas – and the nation.

And yet Kansas state revenue is growing because our small businesses are growing. And they are hiring. Kansas unemployment has been very low for years, beating the national rate by significant margins. Small business is the one engine that is really producing income for tax-paying Kansans.

Economic growth will increase revenue more than new taxes. Revenue from increased taxes will be a burden on the Kansas economy. We do not need increased taxes – we need to continue to grow the Kansas economy and increase income for everyone – wage earners, businesses, and yes, even government.

Restructuring the budget is not enough. There is much talk of a “structural imbalance” in the Kansas state budget. That is true in that projected income is not matching projected spending.

As mentioned, growth of the economy combined with reduced spending will provide “balance” in both the economy and the state budget. And, that growth will increase revenues to local government as well. But, increasing taxes at this time could derail the recovery in Kansas.

This week, Standard and Poor’s downgraded Kansas’ credit rating for the state’s continuous use of one-time revenue measures to shore up operational spending . . . [including] a plan to sell bonds backed by a nationwide settlement with U.S. tobacco companies, liquidation of a capital reserve. (Reuters). This is not the first time that Kansas has seen a downgrade and it is always for the same reason, spending more than it is taking in.

The rating agency (which has serious problems of its own) has always cited the various ways that Kansas has been coping with the budget gap as indicators that the gap is not being fixed. They are correct. However, it does not mean that taxes must be raised; it does mean that spending must be brought into line with income.

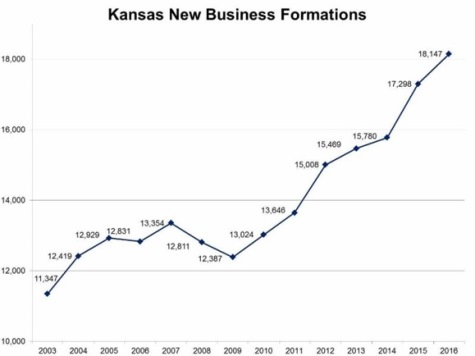

New businesses are way up

New business formations continue to accelerate. These are almost entirely businesses formed by taxpayers that have not paid taxes in the state before – SSNs that are entirely new to Kansas. This reflects the new business friendly atmosphere in Kansas and the historic lag of business growth.

These businesses have been hiring and they have been spending money in Kansas, which is why Kansas has had a very low unemployment rate and why revenue to the state has continued to grow despite the crash in the energy and agriculture markets. Private employment is up both in actual numbers and as a percentage of the total workforce.

That means more taxpayers per government worker – reversing an unhealthy trend that dominated Kansas for decades, decades when Kansas shrank relative to the rest of the country, going from eight representatives in Congress to four. We are starting to turn the corner on reversing that trend by improving the business climate and increasing private growth while holding down the growth of government.

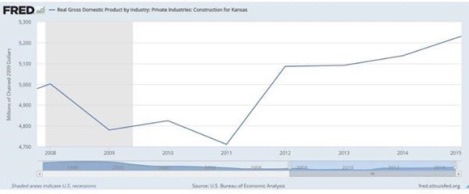

Construction in Kansas is up

Western Kansas and other parts that are heavily dependent on agriculture and energy are not participating in the construction boom. But, the rest of Kansas is building as shown here. The shaded area of the chart is the U.S. recession and the rapid rise after 2011 is fairly well sustained – especially considering the drop in agricultural prices.

It is not surprising that new businesses and expanding businesses are causing new construction – both commercial and residential.

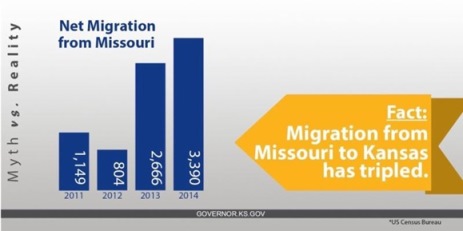

Along the border the differences are much more apparent and after decades of losing population to Missouri and other states the tide has turned – people and businesses are coming into Kansas in increasing numbers.

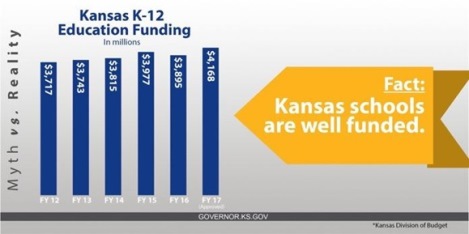

State funding for K-12 education has been increasing – going over $4 billion for the first time this school year. This does not count federal and local funding which is significant. And, it does not count the state’s part of the debt for repayment of bond principal and interest for school facilities which has just reached $6 billion – essentially tripling in the last 20 years.

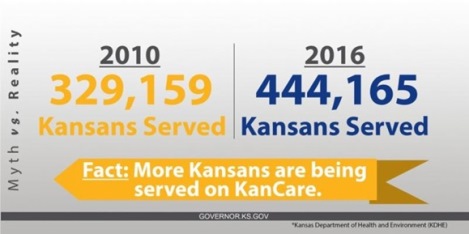

The thought that we must raise taxes to pay for KanCare is simply wrong. We have been increasing the number of Kansans cared for and we can continue without a tax increase.

Senate floor action:

Updating the code of civil procedure (SB 13) provides that the code shall be employed by the court and the parties to secure the just, speedy, and inexpensive determination of every action and proceeding. The law currently requires the Code to be liberally construed and administered for the same purpose. Passed the Senate 39-0.

Amending the state banking code (SB 20) updates language concerning a bank’s investment in foreign bonds to clarify the amount cannot exceed one percent of the bank’s capital stock and surplus; amend language relating to lending limits to provide an exemption for segregated deposits and would require any bank or trust company owning tangible property to insure that property against loss. Finally, the bill requires banks and trust companies to record minutes of annual stockholders’ meetings and detail any action taken by the stockholders, including the election of directors. Passed the Senate 39-0.

Amending the Kansas Money Transmitter Act (SB 21): amends provisions of the Kansas Money Transmitter Act (KMTA) to add a definition of “service provider.” Passed the Senate 39-0.

Amending the Insurance Holding Company Act (SB 16): Updates and adopts National Association of Insurance (NAIC) language concerning group-wide supervisors. The Kansas Insurance Commissioner acts as the group-wide supervisor for any internationally active insurance group and may acknowledge another official as the supervisor. Secondly, the bill creates new law based on the NAIC Corporate Governance Annual Disclosure (CGAD) Model Act, whereby insurers submit a CGAD to the Insurance Commissioner each year. Passed the Senate 38-1.

I voted for this bill

Insurance coverage of self-service storage units (SB 14): Allows the Insurance Commissioner to issue limited licenses to self-service storage companies. The license holder may act as an agent of an insurer authorized to write insurance in Kansas. Such policies issued by self-service storage companies shall not exceed $5,000 of coverage per customer per storage unit. Passed the Senate 38-1.

I voted for this bill

Amending the Kansas Mortgage Business Act (SB 18): Amends provisions of the Kansas Mortgage Business Act (KMBA) clarifying that only a KMBA license is required to conduct mortgage business in Kansas, and that the required annual reports submitted by each KMBA licensee remain confidential. Passed the Senate 39-0.

Committee action:

Hands-free calling while driving (SB 99): The Senate Committee on Transportation held a hearing on SB 99, a measure that prohibits drivers from holding a cell phone up to their ear while operating the vehicle. It was noted that distracted driving continues to be the leading cause of car accidents in the United States.

No cell phone usage in construction or school zones (SB 144): The Senate Committee on Transportation heard additional testimony concerning driving and using a cell phone, but more specifically while in school or road construction zones. Talking on the phone with a hands-free device while in these zones would be legal if the call was initiated before entering such zones.

Online sales tax (SB 111): The Senate Committee on Assessment and Taxation Wednesday heard testimony concerning online sales tax collected at the time an individual makes a purchase from an online retailer. Current law requires consumers who purchase goods online to remit the sales tax to Kansas if they were not charged tax by the online retailer. SB 111 requires the online retailer to collect the correct tax at the time of purchase or send an annual statement to consumers letting them know the amount of untaxed sales they purchased throughout the year.

Woman’s right to know act amendments (SB 98): The Senate Federal and State Affairs Committee heard testimony regarding the inclusion of additional information to the Woman’s Right to Know Act. SB 98 requires referring physicians or physicians who perform abortions to disclose their name, medical education, any disciplinary action taken against them by the Kansas Board of Healing Arts, their malpractice insurance, and other information. On Wednesday, the committee voted 6-3 to pass the bill favorably.

Key bill introductions

No sanctuary cities in Kansas (SB 158): This bill would prohibit municipalities from enactment or adoption of policies which establish a sanctuary city, and would prohibit state agencies from adopting sanctuary policies.

Allotment authority of the governor amendments (SB 161): Requires the governor to make budget adjustments, given that revenue streams will not fully fund the state’s expenditures as determined by law. In current law, the governor has the ability of using the allotment system in order to prevent a fiscal shortfall, but is not required.

This week

The Senate will focus on producing a comprehensive balanced-budget package. Senate leadership does not plan to allow a vote on any non-budget related bills until the budget is passed.

Wednesday:

Hearing on SB 161, allotments; requiring the governor and secretary of administration to act under certain circumstances – [Senate Ways and Means, Wednesday, February 15, at 10:30am]

Hearing on SB 74, people with certain disabilities; motor vehicles registration information and notation on state-issued identification cards – [Senate Transportation, Wednesday, February 15, at 8:30am]

Thursday:

Final Action, SB 47, amending the Kansas pet animal act – [Senate Agriculture and Natural Resources, Thursday, February 16, at 8:30am]

Final action, SB82, establishing restrictions on health insurance use of step therapy protocols, SB 153, requiring targeted case management for recipients of home and community based services – [Senate Public Health and Welfare, Thursday, February 16, at 9:30am]

Hearing on SB 119, Kansas universal service fund and Kansas lifeline support – [Senate Utilities, Thursday, February 16, at 1:30pm]

Hearing on SB 166, exempting Cleveland university-Kansas City from the private and out-of- state postsecondary educational institution act – [Senate Education, Thursday, February 16, at 1:30pm]

Friday:

Final Action, SB 126, restrictions on persons interacting with child care facilities, SB 154, Amendments to home health agency licensure – [Senate Public Health and Welfare, Friday, February 17, at 9:30am]

Session dates and deadlines

Please be aware of the following dates and deadlines for the 2017 Legislative Session. As always, each is subject to modification and leadership will keep you updated on any changes which might occur.

Monday, Feb. 20 Last day for morning committees to meet

Thursday, Feb. 23 Turnaround, last day for non-exempt bills in house of origin

Friday, Feb. 24 No session

Feb. 27-March 3 No Session

Friday, March 24 Last day for non-exempt bill introductions, non-exempt committees to meet

March 27-30 On the floor all day

Thursday, March 30 Last day for non-exempt bills in either house

Friday, March 31 No session

Friday, April 7 Drop dead day, first adjournment

Monday, May 1 Veto session begins

Sunday, May 14 Day 90

Sen. Steve Fitzgerald, R-5th Dist., Leavenworth, also represents part of western Wyandotte County.