by Mary Rupert

Unified Government Administrator Doug Bach presented a $376.4 million budget for 2019 with a 2-mill city tax reduction on Thursday night in a UG Commission meeting. At the same time, assessed valuation is going up an average 7.9 percent this year.

Bach said the budget contained a mill rate decrease for the city, while the county mill rate will remain the same. It is a 5 percent cut in the city mill levy rate this year.

The UG Commission will discuss the proposed budget this month, may change it if they want, and the commission is scheduled to make a decision on it Aug. 2. According to Bach, his budget was based on goals set by the commission, as well as on citizen surveys.

Bach talked about positive trends in the community, including property values increasing, housing starts going up, a population increase, school districts expanding, new job creation, commercial development, expansion of the University of Kansas Hospital on its campus and in downtown, recognition of Kansas City, Kansas, as the soccer capital of the United States, renovation of Leavenworth Road, moving forward with the Northeast Master Plan, and building fiber infrastructure throughout the community.

The budget calls for a 2 percent cost-of-living raise for most employees, and a 3 percent raise for police and sheriff’s employees, he said. There are no cuts to services and employees, he said.

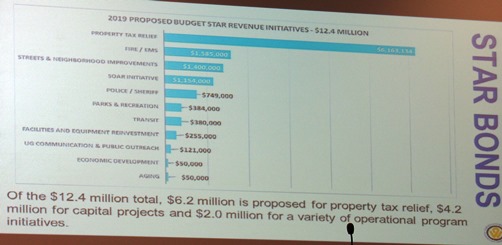

According to Bach, the budget continues the UG’s efforts to focus on neighborhoods and reduce blight by increasing mowing operations, budgeted at $726,000; boarding up vacant structures, $280,000 budgeted; demolition of 121 unfit and abandoned structures in 2019, $2 million of debt financing and $750,000 in cash funding; rehabilitating vacant properties with shifting part of the Land Bank’s $75,000 budget to a program that helps the private sector rehabilitate vacant properties; an additional $780,000 in Community Development funds for the Park Drive neighborhood development project, primarily at City Park; a Strawberry Hill initiative, an effort to help stimulate people investing in the neighborhood; a Choice Neighborhood Grant with the opportunity to leverage $1.3 million for the Juniper Gardens area; and the Strong Towns initiative, which states that strong towns must be built from within, a little at a time, through neighborhoods.

Bach also mentioned economic development projects including the downtown grocery store, with a development agreement coming to the commission in August; the Turner Diagonal project, with a residential, commercial and industrial development; and the American Royal project, which is continuing to move forward.

He said the UG is seeking renewal of the three-eighths cent sales tax at the Aug. 7 election, which will be used for public safety and infrastructure. The sales tax brings in a little over $10 million annually, and a portion of it is paid by people who do not live here but shop in Wyandotte County.

Other details in the budget

Kathleen VonAchen, UG chief financial officer, said the UG will achieve the 17 percent recommended reserves for 2019 for the city under the proposed budget.

On the county side, there are $3.5 million in additional expenditures, mainly in personnel costs and some one-time items. The county will be dipping into the fund balance for $1.575 million in 2019, she said. The county will have an ending fund balance of 13.4 percent, below the recommended 17 percent. The reserves are being used for unanticipated activities, mostly one-time, she said.

Some of the $20.5 million of street projects in the budget, according to Melissa Sieben, assistant county administrator, are Leavenworth Road, 63rd to 78th Street; and design and engineering for Minnesota Avenue from 6th to 7th streets; street maintenance projects through the city; and safe routes to schools program.

The budget contains the purchase of two transit vans, one cutaway bus, and a regional fare collection system, she said.

The water pollution control budget includes a 5 percent sewer rate increase, the Kaw Point biosolids project, and a Wolcott treatment facility, she said. The sewer rate increase is down from 7 percent this year, she added.

Gordon Criswell, assistant county administrator, said the budget includes MyResource Connection, which helps counties track who is getting services and cut down on duplication; and the Kansas City, Kansas, Police Athletic League, which provides a program for youth that introduces them to careers in public service and law enforcement.

In addition, the Central Avenue Area Plan is included in the budget, he said.

The budget also includes 30 police patrol vehicles, mandatory tasers for all operational field units, and a contract with the Johnson County forensic scientist for testing at their labs.

Four vehicles for the Sheriff’s Department, the district attorney’s budget would include funds for electronic imaging and software upgrades, UG buildings would receive security camera upgrades, and upgrades are planned for the radio encryption software and equipment, he said.

According to Joe Connor, assistant county administrator, there are plans for two pumpers and one fire quint, two EMS support vehicles, and four support vehicles. There is also a plan for laundry equipment, lockers and bunker gear, which is aimed at reducing exposure to cancer-causing chemicals.

Also in the budget is the replacement of the public health department’s medical software records system, he said, and a traffic video storage program.

Parks and recreation budgeting includes City Park improvements, playground replacements and a park fitness court. The programs will be through Community Development funds and other grants, he said.

According to Bach, the proposed UG budget is not growing the size of the government, but is fiscally sustainable for the future.

He said there is an $8.8 million increase in operations. There is a $4.2 million increase for salaries, the health fund is looking at an $1.3 million increase, the worker’s compensation fund is up $1.5 million, and the retirement rate will see a $1.8 million increase.

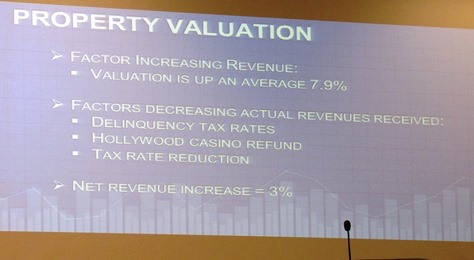

Property tax revenues are up about 3 percent, sales tax and enterprise funds are up 3 and 4 percent, and fees are up about 1 percent, he said.

He said the reason property tax revenues are not up 7.9 percent, the valuation increase, is that there is a 6.9 percent delinquency tax rate; the valuation of Hollywood Casino has continued to decline and the UG may have to refund tax dollars to it; and there is a 2 mill tax rate reduction in the city.

The Board of Tax Appeals has ruled the value of the Hollywood Casino is lower than what was originally anticipated, and lower than the value it was appraised, he said. There may be a final ruling on it next year.

It will have a $2.5 million effect on the community, according to Bach, with one of the larger effects on the Bonner Springs School District, as it is within that district’s boundaries. For the UG, it will have a $1.2 million effect in 2019, he added, and could continue to have a negative effect on revenues in the future, paying back for previous years.

Bach’s budget also recommends $500,000 this year and $500,000 next year toward the costs of the Schlitterbahn court case, he said. Although it is not yet certain whether the UG will have to pay it or how much it will be, the UG could possibly be billed for the cost of prosecuting the case. The funds would come out of reserves, he said.

The budget does not contain any proposed change to the 11.9 percent PILOT (payment in lieu of taxes) fee that the UG places on the Board of Public Utilities’ bills, Bach said after the meeting.

Also, the new Piper fire station is still in the budget, and the target is this fall, Bach said, with preliminary work currently being done with architects and engineers.

Another big project that is still in the works is the county juvenile justice system building downtown, he said. He will be discussing changes to the cost of the project, which went over estimates, with commissioners at a later meeting, he added.

A look at the tax on a $100,000 home

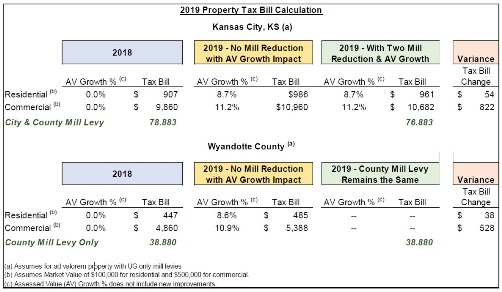

The city’s mill levy drops to about 38.003 mills under the proposed 2019 budget, bringing it under the county’s proposed mill levy rate of 38.880 for the first time in many years.

While the mill levy rate will be lower for the third straight year for Kansas City, Kansas, assessed valuation was up an average 7.9 percent this spring. That means the city-county portion of the tax bills will be going up slightly from last year for most people.

The UG presented a chart that showed that a $100,000 house with an assessed valuation growth of 8.7 percent would pay $961 in taxes this year with a 2-mill reduction, compared to $907 last year in city taxes, for an increase of $54. The county portion of the home’s taxes, with an 8.7 percent assessed valuation increase, would be $485 in 2019 as compared to $447 in 2018.

A commercial property with an 11.2 percent assessed value increase would pay $10,682 with a 2-mill reduction in 2019 in city taxes, as compared to $9,860 in 2018, an increase of $822. For county taxes, the same commercial property that paid $4,860 in 2018 would pay $5,388 in county taxes with a 10.9 percent assessed value increase, an increase of $528.

The UG also compared this year’s tax rate with a $100,000 house that would have paid $1,116 in city and county taxes in 1996, as compared to $884 in 2019, a reduction of 21 percent over the 23 years.

The taxes cited here do not include school, college and state taxes that are also on the property tax bill. The UG’s portion is about 46 percent of the resident’s property tax bill.

Bach said 38-mill city tax rate includes about 16.9 mills that goes toward the UG’s debt. Six mills that have come out of that debt figure accounts for a 22 percent reduction in the city’s operating budget over the past three years, he said. It is something for the commission to keep thinking about, he added.

The city has gone from the highest mill rate of 25 first-class cities in Kansas in 1996 to 13th in 2018, he said. The county is currently 95th out of 105 counties, one of the lowest.

Bach’s proposed budget next will be the subject of several budget workshops in July, with the approval of the budget by the UG Commission scheduled Aug. 2.

Other upcoming UG budget workshop dates include:

• 5 p.m. Monday, July 16, UG Commission to set maximum mill levy, budget workshop, in fifth floor conference room, City Hall;

• 5 p.m. Thursday, July 19, budget workshop, fifth floor conference room, City Hall;

• Monday, July 23, budget workshop, immediately following the standing committee meetings that begin at 5 p.m., fifth floor conference room, City Hall;

• 5 p.m. Thursday, July 26, budget workshop, fifth floor conference room, City Hall;

• 5 p.m. Monday, July 30, budget workshop and final public hearing, Commission Chambers, lobby level, City Hall;

• 7 p.m. Thursday, Aug. 2, budget adoption, Commission Chambers, lobby level, City Hall.

More budget details are online at the 680-page UG budget book, https://www.wycokck.org/WycoKCK/media/Finance/Documents/Budget/2018-Amended-2019-Proposed-Budget.pdf.