Some premiums will drop, others will rise. So experts recommend taking the time to comparison shop, even if you like the health insurance you bought last year.

by Celia Llopis-Jepsen, Kansas News Service

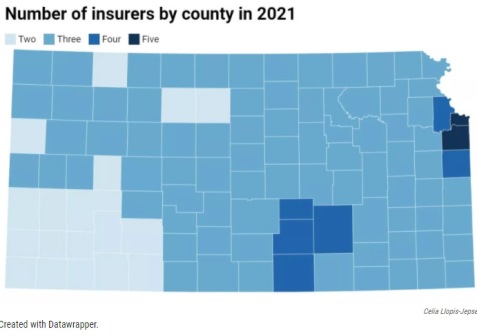

If you’re buying health insurance on the Affordable Care Act exchange in Kansas, for 2021 you’ll have more options than ever — including a big player that sat out the Obamacare market the past few years.

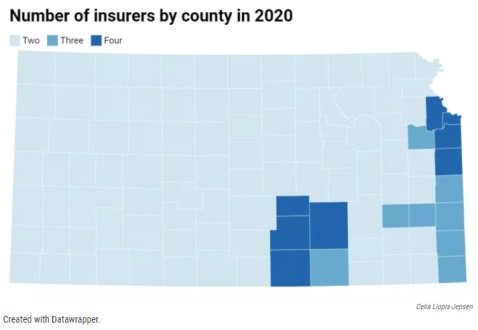

The 2020 market already brought a dramatic increase in options. That trend will continue. A half dozen insurers are now vying for customers.

Availability varies depending on where you live, but now even most rural areas — where choices have been more limited — will get to choose from at least three insurance companies. One glaring exception: southwest Kansas.

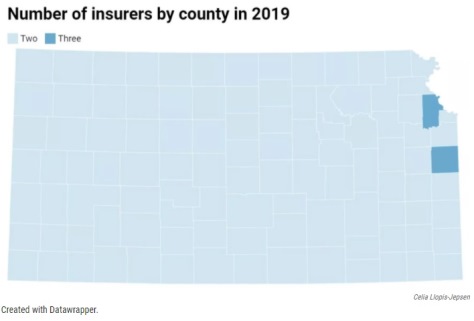

Check out the maps at the bottom of this story to see how the market has developed.

The trend in Kansas:

• 2019: Three insurers offered 23 plans.

• 2020: Five insurers offered 82 plans.

• 2021: Six insurers are offering 100 plans.

“Insurers are really feeling confident that they’re going to be able to succeed in the marketplace,” said Katherine Hempstead, a senior policy adviser at the Robert Wood Johnson Foundation in New Jersey. “It’s becoming increasingly desirable. … That’s a really good sign.”

Some premiums will go up this year and some will go down. She recommends that you check your options, even if you already bought a plan last year that you liked.

You can enroll through Dec. 15 for policies that start Jan. 1. It’s only possible to buy a plan at other times of the year if you run into significant life changes.

Many people qualify for financial help. For 2020, the Kansas Health Institute* estimates, the average monthly premium was $101 a month after tax credits.

What else to know about 2021

Blue Cross Blue Shield of Kansas City is jumping back into the market after pulling out at the end of 2017.

Like last year, all of the plans on offer in Kansas limit coverage to their networks. If you pick a doctor or hospital outside their networks, don’t expect any help unless it’s a medical emergency.

If you need coverage for specific medications or doctors, you should check which plans include them in their networks before you sign up. It can help to call insurers and confirm they cover what you need, because networks change yearly and sometimes online information is out-of-date.

You can find someone to help you compare plans and fill out your application on Healthcare.gov. That tool will show you experts trained to sort through the options near you.

People or groups labeled as “assisters” don’t get paid by insurance companies to sell you their plans. And they are required to give impartial information.

People labeled as “agents” or “brokers” generally earn commissions on sales. Some of them only offer plans from specific insurance companies that they work with.

You can also call the Healthcare.gov hotline (1-800-318-2596) for help.

*The Kansas Health Institute receives funding from the Kansas Health Foundation, which also provides funding to the Kansas News Service.

Celia Llopis-Jepsen reports on consumer health and education for the Kansas News Service. You can follow her on Twitter @celia_LJ or email her at celia (at) kcur (dot) org. The Kansas News Service is a collaboration of KCUR, Kansas Public Radio, KMUW and High Plains Public Radio focused on health, the social determinants of health and their connection to public policy.

Kansas News Service stories and photos may be republished by news media at no cost with proper attribution and a link to ksnewsservice.org.