A tax preparer in Kansas City, Kan., was indicted today by a federal grand jury on charges of preparing false tax returns, U.S. Attorney Barry Grissom said.

Ahferom Goitom, 34, Kansas City, Kan., is charged with fourteen counts of preparing false tax returns.

The indictment alleges that Goitom was a professional tax return preparer who worked in Kansas City, Kan., and was the manager of a franchise business that prepares tax returns.

He used commercial tax preparation software at the business to file returns electronically with the Internal Revenue Service.

He prepared at least 34 Form 1040s containing false and fraudulent education credits, charitable deductions, medical and dental expenses, home mortgage interest deductions, gross receipts for a sole proprietorship business, expenses for a sole proprietorship business and deductions for rental real estate.

For example, count one of the indictment alleges Goitom filed a return for a taxpayer in calendar year 2009 claiming medical and dental expenses of $5,050; gifts to charity of $8,200; and job expenses and miscellaneous deductions of $5,821. He knew that the taxpayer was entitled to claim medical and dental expenses of only $226, gifts to charity of approximately $2,000 and no job expenses or other miscellaneous deductions, according to the indictment.

If convicted, he faces a maximum penalty of three years in federal prison and a fine up to $250,000 on each count. The Internal Revenue Service investigated. Assistant U.S. Attorney Scott Rask is prosecuting.

Other indictments by the grand jury include:

– Lamar Lynch, 41, Kansas City, Kan., is charged with 13 counts of stealing government funds by filing false and fraudulent federal income tax returns and nine counts of aggravated identity theft.

The crimes are alleged to have occurred in 2011 and 2012 in the state of Kansas. If convicted, he faces a maximum penalty of 10 years in federal prison and a fine up to $250,000 on each count of filing a false tax return, and a penalty of not less than two years and a fine up to $250,000 on each count of aggravated identity theft.

The Internal Revenue Service – Criminal Investigation Division, U.S. Secret Service and Housing and Urban Development – Office of Inspector General investigated. Assistant U.S. Attorney Tris Hunt is prosecuting.

– Randy A. Cornelius, 21, Kansas City, Mo., Allen J. Williams, 23, Kansas City, Mo., and Alvin J. Williams, 23, Kansas City, Mo., have been indicted on bank robbery and federal firearms charges.

A federal criminal complaint filed Feb. 28 in U.S. District Court in Kansas City, Kan., charged each of the defendants with one count of bank robbery in the Feb. 27, 2014, robbery of Inter-State Federal Savings at 8620 Metcalf in Overland Park, Kan.

Today’s indictment adds a charge against each defendant of using a firearm during the robbery.

In addition, Allen J. Williams is charged with one count of unlawful possession of a firearm after a felony conviction.

If convicted, the defendants face a maximum penalty of 25 years in federal prison and a fine up to $250,000 on the bank robbery charge, and a penalty of not less than seven years and a fine up to $250,000 on the charge of using a firearm in the robbery.

In addition, the charge of unlawful possession of a firearm after a felony conviction carries a maximum penalty of 10 years and a fine up to $250,000.

The Overland Park Police Department, the Kansas City, Mo., Police Department and the FBI investigated. Assistant U.S. Attorney Tris Hunt is prosecuting.

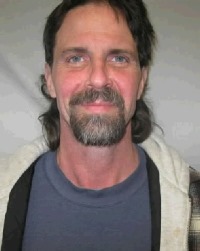

– Jose Angel Aquilera-Franco, 20, Bonner Springs, Kan., and Darin Glassburn, 44, are charged in a second superseding indictment with one count of attempted possession with intent to distribute methamphetamine.

The crime is alleged to have occurred Dec. 5, 2013, in Kansas City, Kan.

In addition, Aguilera-Franco is charged with one count of distributing methamphetamine within 1,000 feet of St. Peter’s Catholic School in Kansas City, Kan., one count of distributing methamphetamine and one count of dealing in firearms without a federal license.

Upon conviction, the crimes carry the following penalties:

- Distributing methamphetamine within 1,000 feet of a school: A maximum penalty of 40 years in federal prison and a fine up to $2 million.

- Distributing methamphetamine: A maximum penalty of 20 years and a fine up to $1 million.

- Dealing in firearms without a license: A maximum penalty of five years and a fine up to $250,000.

- Attempted possession with intent to distribute methamphetamine: Not less than 10 years and a fine up to $10 million.

The U.S. Postal Inspection Service and the Kansas City, Kan., Police Department investigated. Special Assistant U.S. Attorney Erin Tomasic is prosecuting.