by Mary Rupert

A flat mill levy rate with no rate increase from last year was proposed on Thursday night, June 27, by UG Administrator Doug Bach.

Bach presented the 2020 proposed budget with $394.8 million in expenditures to the UG Commission at the meeting. The UG commissioners will hold several budget workshops during the next month, possibly make changes to it, and then vote on the budget.

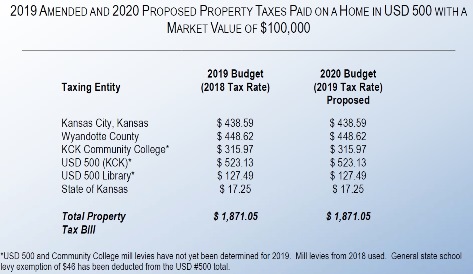

The UG’s portion is about 46 percent of the property tax bill for residents in the Kansas City, Kansas, school district. At the present time, it appears that a lot of the property tax bills that Kansas City, Kansas, residents receive could remain flat. Dr. Valdenia Winn, president of the Kansas City, Kansas, Board of Education, said after the candidate meet-and-greet event Thursday evening at the First Baptist Church, 5th and Nebraska, that a flat mill levy with no rate increase is being proposed for the Kansas City, Kansas, School District.

Dr. Greg Mosier, president of Kansas City Kansas Community College, also said Thursday evening that the college is proposing a flat mill levy with no rate increase.

The schools and local governments usually do not complete their budget process until late July or early August.

“This budget is designed to improve critical infrastructure, increase operational efficiency and effectiveness, improve appearance and safety in neighborhoods, targeted investment to drive future growth, and long-term fiscal responsibility,” Bach said.

Proposed revenues less than expenditures

The amount of revenues in the 2020 UG budget is $25 million less than the amount of expenditures, according to Bach.

The $394.8 million in expenditures is 2.9 percent higher than the 2019 budget, according to officials.

Bach said he would compare the revenue and expenditure situation to portrayals of Lewis and Clark, where their feet are in the water. The UG’s sales tax revenues are down currently, but Bach said he hopes that they will go back up. The UG has to look at efficiencies in the meantime, he said.

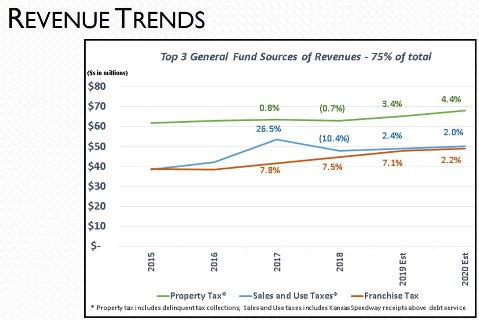

Kathleen VonAchen, UG chief financial officer, said the UG’s sales tax revenues increased by 26 percent in 2017, then they dropped in 2018 by 10 percent. The distributions of sales tax revenues from the state were coming in very strongly in the first half of 2018, but then in the second half, they decreased, she said. The 26 percent increase in 2017 can be mostly attributed to the first year when the STAR (sales tax revenue) bonds were paid off and the sales tax revenues started coming into the UG.

VonAchen said the total assessed valuation is up 5.6 percent in the city and 6 percent in the county.

The delinquency tax rate reduces property tax revenues, she said, and the delinquency rate will be budgeted at 5.7 percent for the city and county in 2020. The city’s delinquency rate decreased from 7 percent to 5.9 percent in 2018, she said. There is a net property tax revenue increase of 4.4 percent.

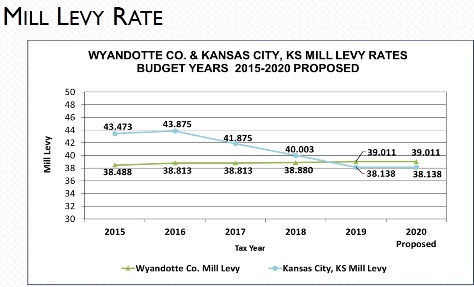

There were three years in a row of property tax rate decreases for the city before this year, when the rate is proposed to stay the same as last year, according to UG officials. In 2015, the city property tax rate was at 43.4 mills, and when it started to receive STAR bond sales tax money in 2017, the UG started to drop the mill rate about 2 mills each year, VonAchen said. The city rate dropped to 38.138 mills last year, and that is where the UG is proposing to keep it for 2020. The county’s rate will stay the same as last year at 39.011 mills, under this proposed budget, and it has not changed very much since 2015.

If residents’ valuations stay the same this year, their tax amounts will stay about the same with this proposed budget. The appraiser’s office recently announced it was inspecting real estate parcels this year in Bonner Springs and in the downtown and Central area.

Reginald Lindsey, UG budget director, said the UG will be using $2.9 million this year from its fund balances in the city general fund side. On the county side, they’re spending $604,000 from the fund balance.

Where the money goes

According to Gordon Criswell, assistant UG administrator, personnel was a big driver to the budget, with a 2 percent cost-of-living increase. In addition, there was an 8 percent increase in health insurance costs, and 5 percent in payouts in pensions and penalties. Contractual obligations including inmate housing saw a 3 to 5 percent increase.

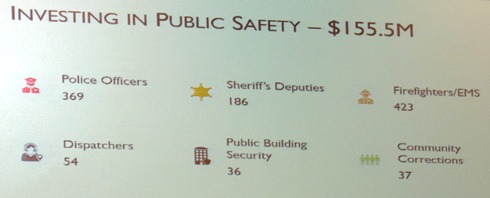

Citizen surveys ranked public safety at the top, Criswell said, and the budget includes $155.5 million for it. The budget includes $5.4 million in providing additional security to buildings, dispatch center upgrades, fire truck lease program, a courthouse fire alarm system and other projects. The juvenile pod will be remodeled to adult jail space and could help reduce the need for inmate farmouts, according to Criswell. Overall, spending on public safety increases in this budget.

Melissa Sieben, assistant UG administrator, outlined $30.8 million in street projects included in the budget: $1 million for 131st and Leavenworth Road improvements near a new Piper school; $200,000 for Fairfax Industrial area infrastructure; $7.5 million for the Turner Diagonal interchange, with more than $20 million coming from the federal government for this project; $500,000 to redo the 7th and Central interchange; $11.5 million for Leavenworth Road, 63rd to 78th streets; and $9 million for Minnesota Avenue repair and maintenance projects from 6th to 7th streets.

More funds have been budgeted for road maintenance projects throughout the city, she added.

Sieben said the UG is budgeting $27.8 million for additional flood control and levee projects. The Argentine, Armourdale and Central industrial district levee raise project has received a $453 million federal grant, and will include the Argentine levee pump station and levee land acquisition. This project will create better flood protection.

Also, the Turkey Creek emergency wingwall repair project, which was approved earlier this year, is included in the budget, she said.

The budget includes $55.5 million for the Wolcott water pollution treatment plant expansion and the Kaw Point biosolids project, she said. The biosolids project may allow the UG to sell fuel produced there.

Sieben said there is a proposal for a 5 percent increase in wastewater rates that it is seeking approval for in 2020. The UG faces a partial consent decree in this area.

The UG administration is currently discussing changing its stormwater rates, she said. The commission, however, did not move forward the administration’s proposal during a recent committee meeting and asked for more information and community input. The 2020 budget proposal shows revenues from the stormwater rates at their current $4.50 per parcel.

The solid waste contract is due for an update and the budget reflects a recommendation for a 25-cent increase, she said.

An additional $1.4 million has been proposed to improve the safety and appearance of neighborhoods. A second SOAR team would be added to address blighted properties, funds are being budgeted for landscape replacement at UG facilities and grounds, and the UG annex parking lot would be expanded.

Alan Howse, UG assistant county administrator and chief knowledge officer, said $1.44 million would be budgeted in “quality of life” investments, including a program that would fill in gaps in sidewalks near schools, parks and other areas, trail network development, Safe Routes to Schools, 18th Street bus route, City and Regan Park improvements, new park restrooms, and a system with the capability to make reservations for park facilities and programs online.

Also, he said $1.76 million is being budgeted for a Bike Share program will be in the University of Kansas Medical Center area, a 6th Street bike lane project, Sunflower Hills Golf Course analysis to look at feasibility of the facility for events, Providence Amphitheater parking lot repairs, and an increase in master planning across the community.

About $450,000 is being budgeted to enhance customer service and communication, according to Howse. It will include online permits and payments, online plan submission, online rental housing registrations, online occupational license processing, field case entries, a 311 closed loop on property code cases, and right-of-way management.

About $1 million is being budgeted for innovation and productivity projects, such as a human relations applicant tracking system, which would add an online application process. Other projects include a new UG phone system, a replacement for a system that provides information about land records, and self-service options to get information from the appraiser’s office, according to Howse.

Bach said the budget includes funding for outside agencies, including the Convention and Visitors Bureau, $400,000, adding to the agency’s $1 million budget. He said this investment can bring back more money through transient guest tax revenues. Also, Wyandot Inc. would receive an additional $24,000 under the budget; K-State Extension in Wyandotte County would receive an additional $11,000; the Downtown Improvement District would receive $2,500; and Wyandotte Economic Development would receive an additional $25,000.

‘Priority-based budgeting’ and looking at areas to cut

Even after the UG dips into its reserves, there will still be a 17 percent fund balance left, according to Bach. He said the UG can stay in that for a year or two, but it needs to keep the fund balance up. On the county side of the budget, the UG will need to look at efficiencies to build up the fund balance, he added.

Bach said he has cut 10 percent from contractual commodities and services expenses throughout departments in the proposed budget.

While there will be no increase to the mill levy rate for the city and county, Bach said he still tried to build in a few new items to the budget.

A 2 percent cost-of-living raise for employees is in the budget, according to UG officials. There will be no layoffs, Bach said, but the UG will be looking at efficiencies in the future, and when an employee retires or leaves, those positions will be evaluated and may not be filled immediately, so that personnel costs may be reduced through attrition.

A priority-based budgeting project started earlier this year and this fall, the UG may get into strategic cuts and identify where it wants to make changes, Bach said.

Some of the budget’s spending was an intentional move to spend cash on one-time items, according to Bach. The transient guest tax fund was built up, and now can be used on items that the fund can pay for. But the $2.9 million on the city side does not fall into that category, and they need to change that trend in the future, according to Bach.

The UG now is starting to target its spending to drive future revenue growth, according to Bach. The UG will consider if an investment into a street or park will have an effect on the area around it, and how it helps the UG raise overall revenue, he said.

The budget will keep its investments in public safety, street maintenance and quality of life, he said.

Future meetings on budget

The first budget workshop is scheduled on July 8, immediately after the Standing Committee meetings on the fifth floor. The commission will set a maximum mill levy amount.

A public hearing on the budget will be at 5 p.m. Thursday, July 25, in the Commission Chambers, lobby level, City Hall.

Other budget meetings include: July 11, July 15 and July 25. These meetings are scheduled for 5 p.m. in the fifth floor meeting room at City Hall, 701 N. 7th St.

A public hearing will be at 5 p.m. Thursday, July 25, in the Commission Chambers, lobby level, City Hall.

The budget is online at www.wycokck.org/budget. The budget meeting is on YouTube at https://www.youtube.com/watch?v=PV3Tak3BsR8.