by Mary Rupert

A $345.7 million budget that will reduce property taxes by 1 mill was proposed today by Unified Government Administrator Doug Bach.

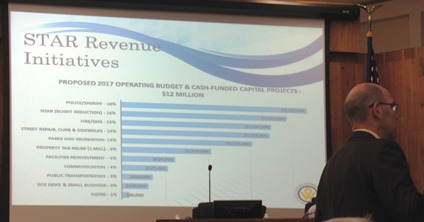

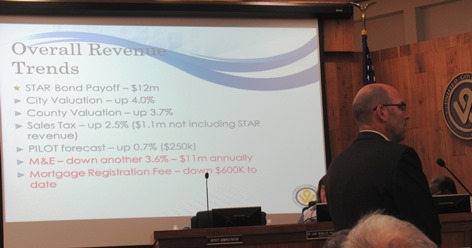

The budget includes $12 million in anticipated revenue in 2017 from the early payoff of The Legends sales tax revenue bonds that was the result of the great success of the shopping district in western Kansas City, Kan., according to UG officials. When the STAR bonds are paid off, there also will be an additional estimated $40 million in revenue for the state of Kansas from Village West.

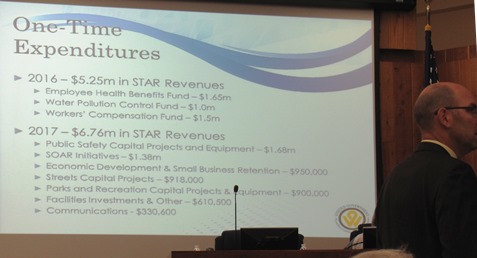

With the extra $12 million, Bach told the UG Commission that he wanted a substantial amount of revenues to repay borrowed funds within the UG budget. In the past several years, the UG borrowed internally from its funds, such as water pollution control and the environmental trust fund. It delayed payments to the health benefits trust fund and workers’ compensation fund in the past.

The UG needs to “put its house in order,” Bach told the commission. Not only did it borrow from its reserved funds in past years, but it also put off expenditures such as maintenance, purchasing new equipment and employee pay.

The proposed UG property tax rate would be 81.6 mills, down from the current 82.6 mills.

The 1 mill proposed reduction in the property tax is expected to total about $11.50 on a $100,000 home, Bach said. One mill represents about $1 million in funds.

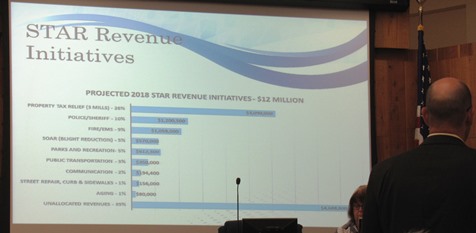

In 2018, a 2-mill property tax reduction is expected to be proposed, he said, bringing the total tax reduction for the two years to 3 mills.

While property taxes are going down slightly, if this budget recommendation is adopted, valuations in the city are up 4 percent and in the county, up 3.7 percent, Bach said. When a home’s valuation increases, it has the effect of slightly raising the total amount owed in property taxes.

Bach said he favored a consistent, steady reduction in property taxes.

During his speech to the commission, he also cited a possibly uncertain economic climate in the future.

In earlier budget discussions, UG officials said that a state property tax lid may have the effect of local governments not wanting to lower taxes because they would not be able to raise them again in the future.

Building up the UG’s bond funds again is expected to help the UG with lower bond interest rates in the future, Bach said.

He proposed, from the STAR bond funds, that $2.4 million go to the Employee Health Fund; $2.2 million to the Workers’ Compensation Fund; $1 million to the Water Pollution Control Fund; $1.5 million to capital equipment purchases; and $800,000 to expanded street repaving and improvements.

Bach told the UG Commission that with this budget, “you need to earn money before you spend money.”

The timing of the $12 million in STAR bond payoffs doesn’t start until the end of the year, he said. While it is estimated at $12 million, the actual amount could change based on sales – a different type of revenue compared to property taxes, which are more stable.

UG Budget Director Reginald Lindsey said the proposed city general fund was $152.8 million and the county general fund was $59.17 million.

According to Lindsey, property tax makes up 25 percent of the UG’s revenues, with sales tax at 19 percent, followed by charges for service at 16 percent and franchise tax at 12 percent.

Sales tax is expected to increase 2.5 percent this year, not including the STAR bond revenues.

The payment in lieu of taxes (PILOT) fee on BPU customers’ bills is proposed to stay at the same rate this year, according to Lindsey. However, the UG is expected to receive about $250,000 more from the PILOT fee this year because of the hot summer weather increasing energy usage.

On the negative side, the machinery and equipment tax that the UG formerly received was eliminated several years ago, a cost of $11 million annually Bach said. The loss of mortgage registration fees will cost the UG hundreds of thousands of dollars, he said.

According to UG officials, the dedicated 3/8-cent public safety and neighborhood infrastructure sales tax produces $9.3 million, with visitor spending at Village West accounting for $2 million of it.

There will also be more than $2 million in additional guest taxes paid by tourists at the Village West hotels when the STAR bonds are paid off. The only use allowed for the funds is tourism. The administrator’s proposed budget says $250,000 more will be allocated to the Convention and Visitors Bureau, and in all it will receive $1 million. The rest of the new $2 million is proposed to be put in a special fund for tourism and marketing of tourism activities, according to the proposed budget. Also in the fund would be money from the Hilton Garden Inn sale. The UG is planning to spend $2 million of the sale money to fix up the Reardon Convention Center, with another $2 million from the sale being put in the reserve account for future debt payments, according to the budget proposal.

UG officials cited citizen surveys and the mayor’s listening tour as influencing some of the priorities of the UG’s budget in spending the $12 million windfall.

Spending proposed by this budget recommendation:

• $1.9 million for blight reduction, including demolition, with 1,000 additional properties being processed for a tax sale;

• A new UG-operated tow lot;

• Many street resurfacing and repair projects and other public works spending, including the Leavenworth Road 38th to 63rd Street project and the 10th to 12th Street and Metropolitan to Quindaro bike routes;

• The Wolcott wastewater plant planning and design;

• Fairfax force main replacement;

• Final year of Turkey Creek stormwater improvements;

• More parking space at the UG annex building;

• 10 dump trucks and two street sweepers;

• Land acquisition and facility planning for the Fire Department;

• Double-bunking modifications at the jail, with funding for 15 deputies, elevator repairs and roof replacement;

• Juvenile complex planning and design;

• 4 vehicles for the Sheriff’s Department;

• 30 vehicles for the Police Department;

• 4 Fire Department apparatus;

• 2 ambulances for the Fire Department;

• An additional $250,000 in funding for Wyandot Mental Health. The community mental health facility is facing state budget cuts;

• Replacing of election voting machines, $1.3 million;

• A 2 percent increase for employees.

There are many other proposed budget expenditures, as well.

Commissioner Mike Kane noted during the meeting that he was very concerned about a fire station being built in western Kansas City, Kan.

The budget is scheduled to be adopted July 28. The UG has been holding discussions on the departments during the year, and several budget meetings are scheduled before July 28.

A public hearing on the budget has been scheduled following the 5 p.m. standing committee meetings on Monday, July 25, in the Commission Chambers. Besides the UG budget, the hearing will be on the CDBG, HOME and ESG budgets.

On Monday, July 11, after the 5 p.m. committee meetings on the fifth floor, the UG Commission will set the maximum mill levy at a budget meeting.

Other budget workshops are at 5 p.m. July 18, and 5 p.m. July 21 in the fifth floor conference room at City Hall.

The budget is online at www.wycokck.org/InternetDept.aspx?id=9730&menu_id=954&banner=15284.