by Mary Rupert

About 72 percent of properties in Wyandotte County had increases in their valuations this year, leading some businesses and residents to say that they are planning to appeal.

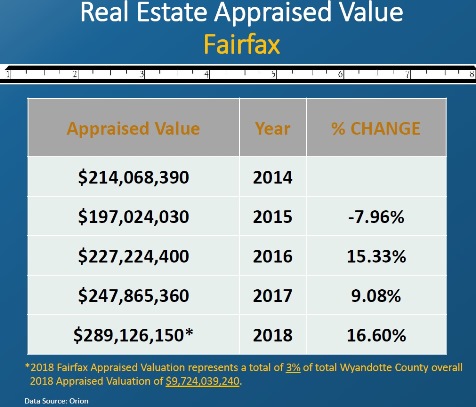

Reports are that some individual businesses in Fairfax had an increase of 50 percent and 70 percent in their real estate valuations. Valuation notices were sent out March 5.

Wyandotte County Appraiser Kathy Briney met with Fairfax business owners and representatives Thursday, in an event sponsored by the Fairfax Industrial Association.

“We don’t create value, people in the marketplace create value,” Briney said on Friday. It is people’s transactions that create the values of property here.

“It’s our legal responsibility to analyze the transactions and apply it to properties,” she said. “That’s our job, I know it’s not a very popular one. The big message is, if they do have questions, I’m all about communication and having people come in and talk with us.”

More demand than supply now in the market

About 72 percent of properties of all types in Wyandotte County saw an increase in valuations this year, Briney said.

For residential properties, there is more demand than supply now in the market, causing prices in the market to increase. This leads to sales with higher prices, which in turn leads to higher valuations of residential properties.

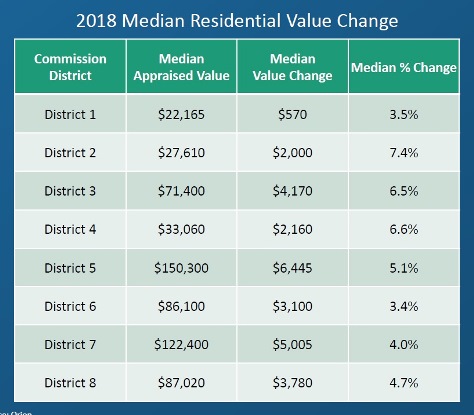

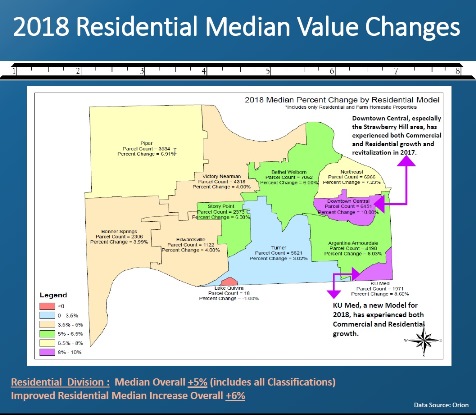

Briney said the median increase for residential properties here was a little over 6 percent.

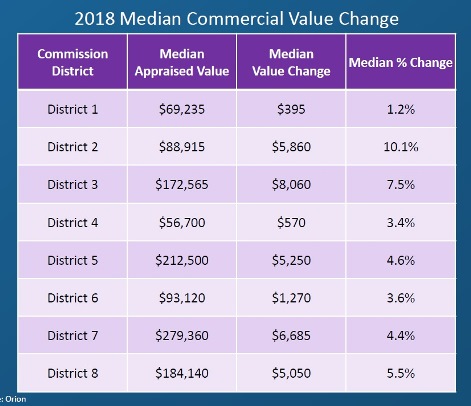

For commercial properties, countywide there was a median increase of about 8 percent, Briney said. Some areas saw larger increases depending on the market, their conditions and specific neighborhoods, she added.

Prosperity leads to higher valuations

“The market is the big indicator,” Briney said in answer to a question on why property values increased. “We’ve come out of a recession.”

For residential properties, there is currently a supply-and-demand issue, she said. It’s a seller’s market, she said. When there aren’t enough homes available to match the demand, the price of homes often goes up.

According to Briney, market reports recently showed that the supply of homes on the market in Wyandotte County is 30 percent lower than the previous year. In some areas of the county, people are buying homes for more than the asking prices because buyers are competing to get a property, she said.

Briney said her office has to follow mandates of the state law and also directives from the Kansas Department of Revenue, Division of Property Valuation. The state requires the local appraiser’s office to appraise properties within 10 percent of market value, she said.

While Wyandotte County was in compliance on the residential side, it was not in compliance of this 10 percent rule on the commercial side, she said. The oversight agency, the Kansas Department of Revenue, conducts annual audits to make sure they meet the mass appraisal and state mandates. The state also checks for uniformity.

The appraiser’s office receives all the sales reports of property in Wyandotte County, and three years are analyzed.

“Our task is to try to follow these market trends and be within 10 percent of market value,” Briney said.

Commercial property in Wyandotte County has been out of compliance of the 10 percent market value for some years, she said. What changed recently is a law that was passed in July 2016 that holds the property valuation division accountable as well as the county to get commercial properties back in compliance, she said.

“We want to get back in compliance,” she said. “What I’m tasked with is following the law.”

What effect will higher valuations have on local businesses?

In the Fairfax industrial district, valuations went up 50 percent and more on some, but not all, properties.

John Latenser, who is with Neff Packaging, a Fairfax business, and is president of the Fairfax Industrial Association, said the association scheduled the Thursday meeting with the appraiser and business owners after they heard about substantial property valuation increases. About 31 persons attended the meeting.

Latenser said Briney and the appraiser’s office have been very open, very willing to talk to the business owners and encourage them to use the informal appeal process available to them. He said he understood that the commercial properties throughout the county were not in compliance and they had to bring the appraiser’s office up to current standards.

In answer to a question, Latenser said it would be hard to say if the Fairfax district would lose businesses as a result of the valuations. There has been an effort by the UG to work to reduce high taxes, he said. The effect of higher valuations may not be that businesses leave the city, but it might be an impediment to recruiting new businesses to locate in the Fairfax area, he said.

Latenser said it is likely that there will be more valuation appeals this year.

Why were some businesses’ valuations increased 50 and 70 percent?

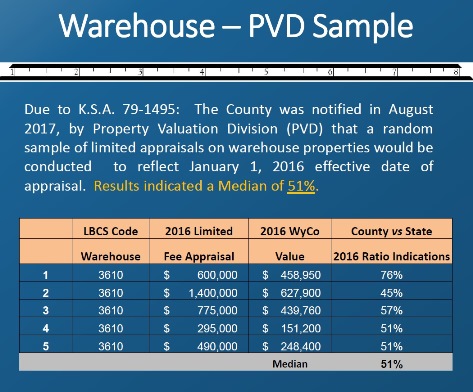

This past fall, the property valuation division hired independent limited appraisers on random samples of property types they deemed were needed, Briney said. One was warehouses and another was downtown rows, where sometimes retail multi-use properties are located next to each other.

A random sample done throughout the county compared values for warehouses, she said. When the values from the independent fee appraisals on warehouses were compared to the assigned values, it came in at about half, or 50 percent value, she said. What is happening in the marketplace currently is a bigger demand for warehouse space.

“Warehouse properties are a very hot commodity right now,” Briney said. The demand on the market has increased. The appraisers’ office is tasked with researching, conducting analysis and it has quite a few sales that are used in this process, she added.

In Fairfax alone, values were at least 40 percent low, she said. Some of these values were increased last year, “but it was like the market just swallowed it up,” as sales prices for warehouse property were rising, she said.

“What we’re trying to do is come back into compliance, and trying to make our model more reflective of the market,” she said.

Why weren’t valuations increased a little at a time instead of all at once on the 50 percent and greater increases?

Valuation increases were not phased in gradually over a number of years on the big increases of 50 percent or greater, not allowing property owners some time to adjust to them.

“I can’t do that,” Briney said. That was not allowed by the law. The property valuations are supposed to be between 90 and 100 percent of the market value, she said. If she knowingly made changes outside this range, it could be a misdemeanor.

Briney said only some properties were affected by 50 percent. She said she understands the concerns of property owners.

At her meeting with Fairfax business owners on Thursday, she said she explained appeal processes.

“We welcome people to come in and talk to us,” she said. For example, if the property owner knows the information is not correct, he or she should come into the office and let them know. There are informal appeal processes and formal appeals.

Property owners in Wyandotte County have until April 4 to file an informal appeal of their valuations, she said. There will be a meeting scheduled to go over property information, and those appealing can bring information with them that might make a difference in the valuation.

If the property owner loses an appeal at the local level, he or she can appeal; there is a process that goes to the Kansas Board of Tax Appeals.

Resident plans to appeal her home valuation increase of $10,000

In the Welborn area of Kansas City, Kansas, Lou Braswell said she plans to appeal the valuation on her home.

“After the shock wore off, I tried to realize why it went up $10,000,” Braswell said about her home valuation. Her three-bedroom home was built in the 1960s. She was speaking as an individual only and not in her capacity with a community organization.

Braswell said she didn’t think houses were much in demand in her particular neighborhood, citing four houses that were up for sale for a year and a half and didn’t sell, and some didn’t even have any showings.

She said she has talked with a lot of individuals whose home valuations have gone up this year.

“I fought it last year and I did win,” Braswell said. After she appealed, her valuation went down $3,000. But now it’s back up again and she plans to appeal again.

She said she thinks it’s worth the time and trouble to appeal it. Braswell didn’t hire anyone to help her appeal it; she did some research herself.

“I went through the whole neighborhood, took a picture of every house, I evaluated what they were appraised at, and I went with a whole folder,” Braswell said.

There is a Unified Government webpage that gives information about each property, when the house was built, how many rooms it has, square footage and what the taxes have been for 10 to 15 years, she said. (It is at http://landsweb.wycokck.org/landsweb/Search/Default.aspx) She used this information in a comparison when she made her presentation to the appraiser’s office on lowering the valuation.

Last year, she presented information that other properties around her were valued less than hers. This year, though, those other properties are all up in valuation, she said.

This year she said she plans to present information that other properties for sale in her area have not sold, to show there is not a big market demand in her neighborhood.

“If you’re not happy with your appraisal, appeal it, the only thing you can lose is a half-hour of your time,” Braswell said.

Information available on appeal process

Information is available on the appeal process and on other aspects of the appraisal process on the appraiser’s web page at http://www.wycokck.org/Appraiser/.

According to information from the UG, residents who are appealing their valuations can include another recent appraisal of the property, photos that show the condition of the property, information about other properties that are similar to the one in question, and other information the property owner feels is relevant.

Instructions for the appeal process, and a form for appealing, also are on the reverse side of the valuation notices that have been sent to residents and businesses. The appraiser’s office is located at the courthouse annex at 8200 State Ave., Kansas City, Kansas, and property owners may call it at 913-573-8400.

Frequently asked questions page on the appraiser’s website: http://www.wycokck.org/Appraiser/FAQ.aspx.