by Mary Rupert

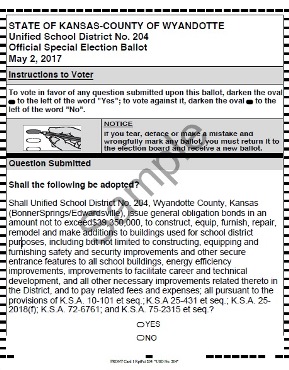

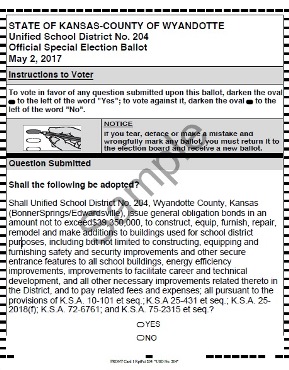

Voters in the Bonner Springs-Edwardsville Public Schools district will decide on a $39.35 million bond issue in a mail ballot this spring.

Superintendent Dan Brungardt said the funds will be used for expanding and building onto existing school buildings, safety and security improvements, and getting students ready for college and careers. Architects looked at the needs of the buildings, and a planning committee developed a bond proposal that was approved by the school board in January. Brungardt added it will not increase property taxes.

If approved by the voters, this bond issue would fund remodeling on all the current school facilities, with the exception of Delaware Ridge Elementary, for increased capacity, he said.

“We’re a growing district in the metro area,” he said. Remodeling should add enough space in buildings for the next 10 to 20 years, depending on enrollment, he added.

During the past 20 years, there has been an average increase of 25 students most years, Brungardt said.

New housing is being built in the Bonner Springs district and is pushing growth, he added. A new single-family housing development, and new townhomes are being built.

In the Delaware Ridge Elementary attendance area, there are many townhomes, plus some single-family construction, he said. Delaware Ridge was the last bond issue the district proposed, around 10 years ago, and it passed.

Edwardsville has a new Village South development that may also attract more growth.

Currently, the Bonner Springs High School has a secure entryway, where students walk through the office he said. The district’s buildings would rearrange front entrances for security purposes under this bond issue. There also are plans to address parking and parent access to relieve access problems, he said.

The bond issue also would fund an upgrade aimed at helping students prepare for college and vocational programs, he said. Manufacturing, home repair, maintenance, business entrepreneurship, video tech production and health pathways are among the programs that would be offered.

The tech area was built in 1964, he said, and current plans call for an attached building to the high school for vocational students.

In addition, two new science classrooms are planned for the high school, and more classrooms are planned at the middle school to deal with increasing enrollment, he said.

“When I graduated it was K-12, now we’re looking at K-13, K-14, K-15,” he said. Students are graduating who already have some college credits earned while they were in high school, sometimes as much as 21 credit hours, he added.

“All schools are becoming more responsible, making sure students not only have the ability to go on, they have the access,” he said. “We have a pathway for nursing, a pathway for construction, business entrepreneurship, also a pathway for police officers.”

The district has a former police officer who is teaching and helps students map out a career in law enforcement, he said. The students on these career pathways get information, learn about the field and make a more informed decision before going into the field to work, he added.

Some high school students are graduating from high school with a certified nursing assistant certificate, and are working in that field to help pay for college, he added.

Brungardt said an important point in this bond issue is it will not make property taxes increase.

“This bond issue is a 0 percent tax increase on the mill levy,” he said. It takes the place of a former bond issue that has been paid off. Property taxes have been stable and flat in the Bonner Springs district over the past several years, he added.

Brungardt added that the bond issue is totally separate from school finance issues that are currently in the news. Bonds can be used only for school facilities, with the state paying 14 cents and the district providing 86 cents on the dollar. The school finance funds are for instruction and can’t be used for facilities.

For the past few years, the Bonner Springs district has received a block grant, the same amount of money it received two years ago. “But our enrollment has increased,” Brungardt said. When enrollment increases, there is a need for more teachers, and in effect, there is less money available, he added.

Legislators will work out the school finance details, and Brungardt said he hopes the district receives additional money for students in order to hire more teachers and keep classrooms at a good size. However, the school finance funds don’t affect the bond issue, and the funds from the bond issue can’t be used for instructional purposes, he added.

The ballot will be mailed to voters on April 12 and should be mailed back to the election office by April 26 in order to reach the election commission office by noon May 2, Brungardt said.

Brungardt has made several community appearances already and is scheduled to make a presentation to the UG Commission on the Bonner Springs school bond issue on April 6. Members of a “vote yes” committee have been going door-to-door to distribute information on the bond issue, he said.