by Murrel Bland

The Bonner Springs Historic Preservation Society has been resurrected. That was the message from Roger Miller, who spoke to the Wyandotte County Historical Society Sunday, March 19, at the Wyandotte County Museum. About 50 persons attended the quarterly meeting.

Miller, a former president of the Historical Society, was a one of the prime movers in reorganizing the Preservation Society. Miller is the former owner of a Bonner Springs pharmacy.

Miller said the Preservation Society was organized in 1973 when the city of Bonner Springs celebrated its 75th anniversary of incorporation. One of the Preservation Society’s major projects was saving the old high school, which became a community center.

Several years ago, the Preservation Society lost many of its active members. Some died; others dropped out and turned to other interests.

But the Preservation Society now has been registered with the Kansas Secretary of State as a nonprofit organization. Interested members meet to discuss future plans at 10 a.m. Saturday mornings at the Bonner Springs Library.

Miller also told a brief history of Bonner Springs. He said it can trace its roots back to the days of Henry Tiblow, a Delaware Indian who ran the ferry across the Kansas River starting in 1830. Each August, the city celebrates “Tiblow Days” in downtown Bonner Springs.

The town was named after Robert Bonner, a New York newspaper publisher who was a big-time race horse owner. The idea was to encourage Bonner and other horse owners to bring their stock to race at a track north of town. However, the track was never built.

Spring water in the area was analyzed; its mineral content was touted as having health benefits. The Bonner Springs Improvement Club created a promotional brochure in 1907 listing these springs. Special trains brought visitors to the area. However, these efforts failed.

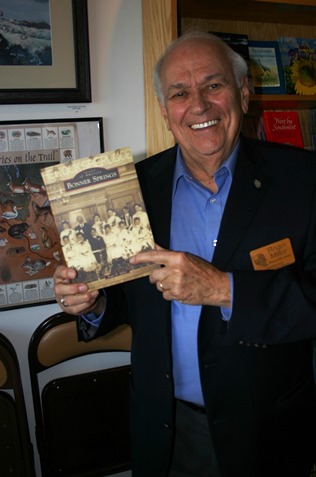

Miller, in cooperation with Arcadia Publishers, Charleston, S.C., has published a pictorial history book on Bonner Springs. It is on sale at the gift store at the Wyandotte County Museum.

The Wyandotte County Historical Society also presented its annual awards.

Dr. Mary Davidson Cohen, representing the Cohen Charitable Trust, received the Garland M. Smith Award. Dr. Cohen was recognized for donating $75,000, which will be used to buy a scanner that will greatly help access historic records. It should be operational later this spring. The Smith Award, which is the highest honor the Historical Society bestows, is named after the late Garland Smith, a longtime society board member and volunteer.

Mary Tenney Gray, who was born in 1833, received the Virginia Smith Award. Gray was most influential in unifying women’s clubs of Kansas and Missouri. She organized the first such association and was its first president. The preamble to that association reads “the object of this society shall be to promote a better acquaintance among thoughtful women…to raise the standard of women’s education and attainments.” She died in 1904. This award is presented annually. Dr. Glandon was a longtime museum volunteer and the first woman to be elected Historical Society president. She also taught history at the University of Missouri at Kansas City.

Dr. Dan Desko was named “Historian of the Year.” He was recognized for helping preserve the history of the B-25 bomber plant that was operational from 1941 until 1945 in the Fairfax Industrial District. The North American Aviation plant produced more than 6,600 aircraft and employed more than 60,000 persons. Dr. Desko also accepted the Margaret Landis Award for the B-25 history project. Landis was a longtime Wyandotte County historian who wrote several articles including those on the Rosedale community.

The Shepherd’s Center of Kansas City, Kansas, received the V.J. Lane Award. The Shepherd’s Center provides educational and health-related services for older adults. Many of the programs deal with the history of Wyandotte County. Melissa Brune Bynum, the executive director of the Shepherd’s Center, accepted the award. Also recognized was Ed Shutt II, a past-president of the Historical Society who presents programs on Wyandotte County to Shepherd’s Center members. Lane was a newspaper publisher and a founder of the Wyandotte County Historical Society.

John (Tiny) McTaggart, the president of the Historical Society, presented the Special President’s Award to Hal Walker. Walker is a past president of the Society and served as chief counsel for the Unified Government. He presently is serving in his second term as a Unified Government commissioner of Wyandotte County and Kansas City, Kansas.

Brenda Cantwell Miller was recognized as “Volunteer of the Year.” Miller, a retired Kansas City, Kansas, school teacher, helped edit historical society publications.

Murrel Bland is the former editor of The Wyandotte West and The Piper Press.